DXtrade XT Web Trader

A branded web trading terminal for your clients

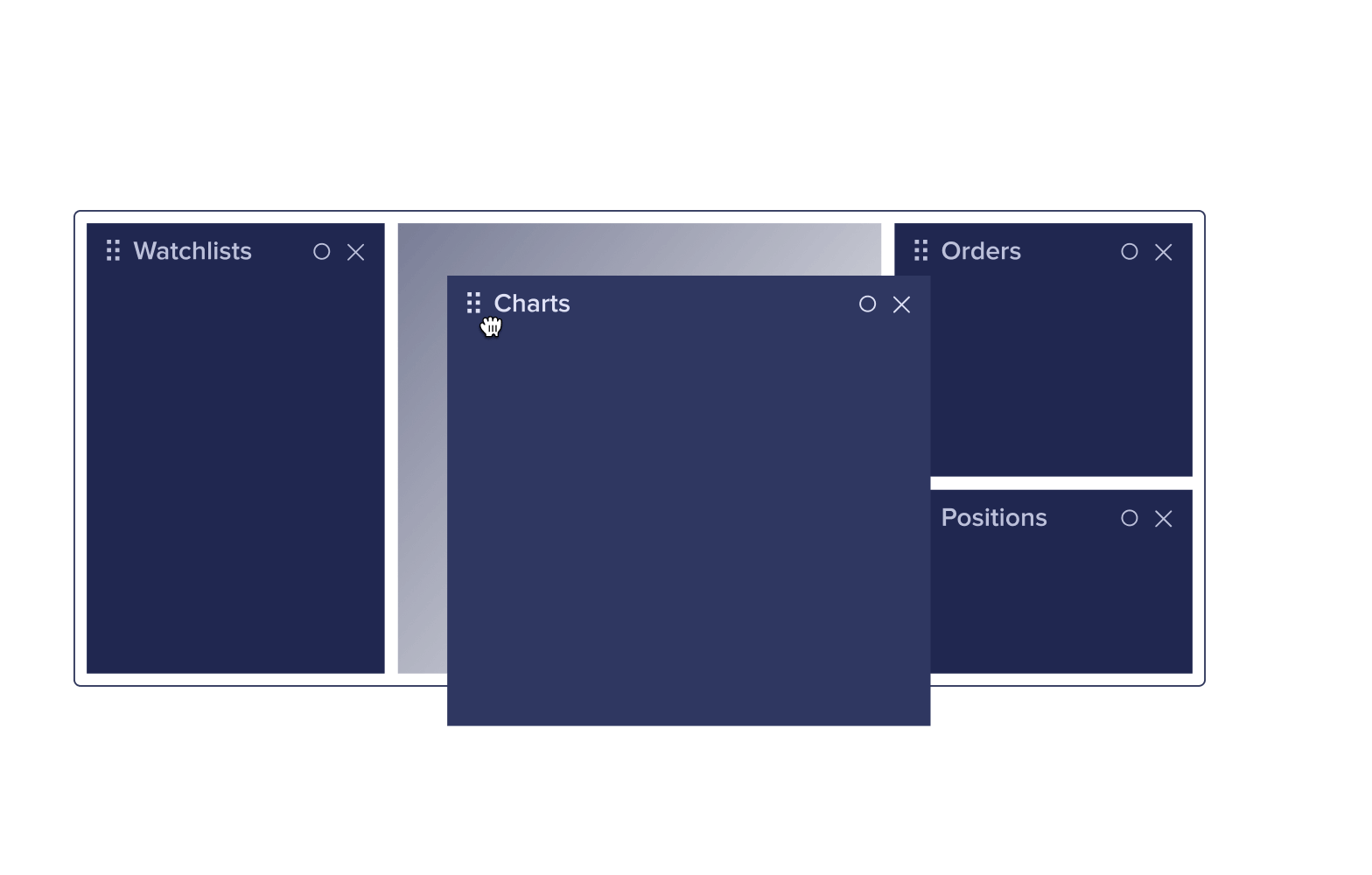

Space optimization

A modular UI allows brokers and their clients to arrange widgets in multiple tabs to form an optimal workspace. All widgets support resizing with drag & drop placement.

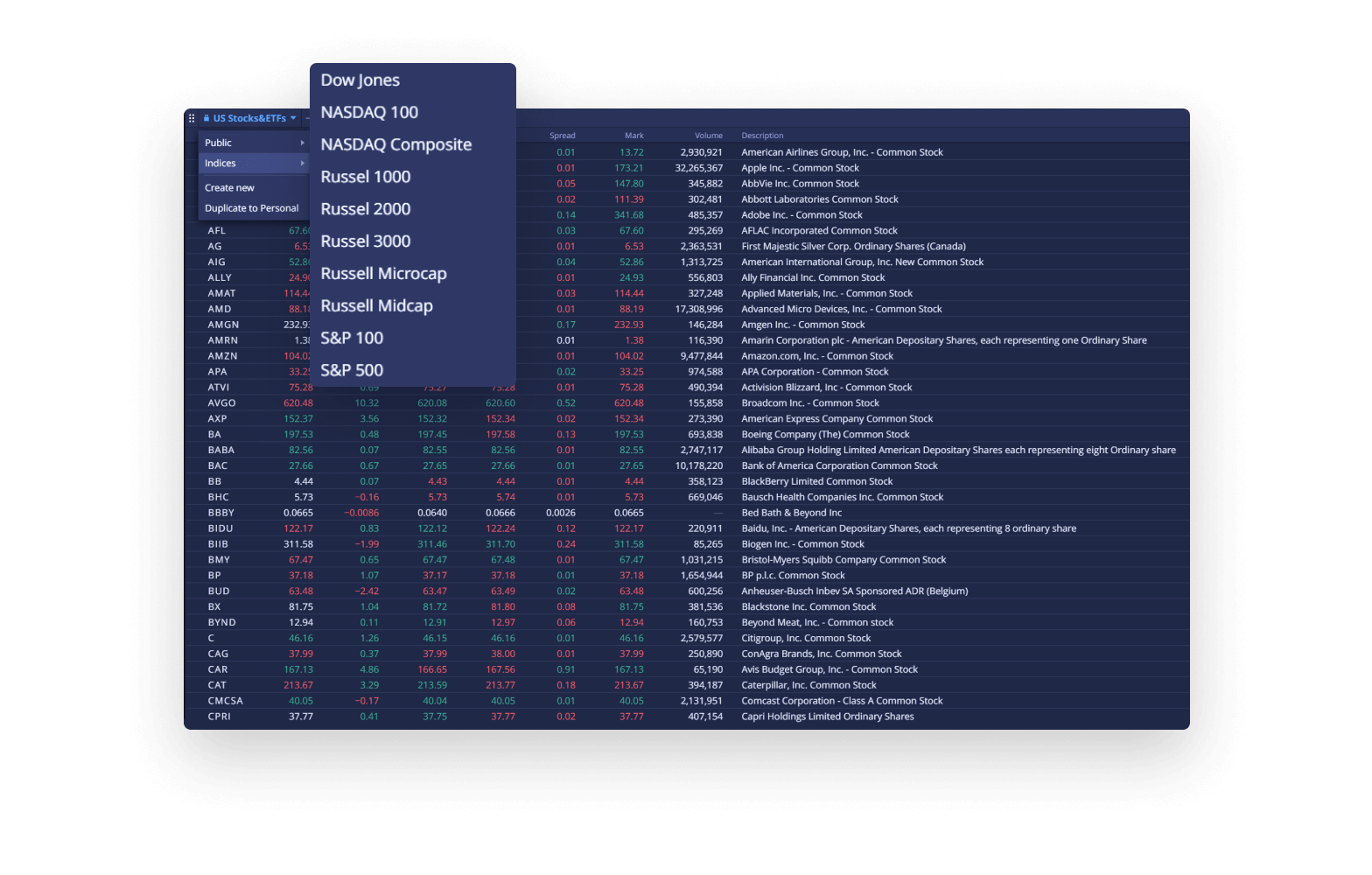

Watchlists and widget linking

DXtrade XT watchlists cater to clients of all experience levels. Brokers can configure public watchlists to represent either static sets of top-rated instruments or popular indices (e.g. DOW 30, S&P 100, etc). Clients can link any watchlist with a chart or news widget to quickly switch the workspace context from one instrument to another.

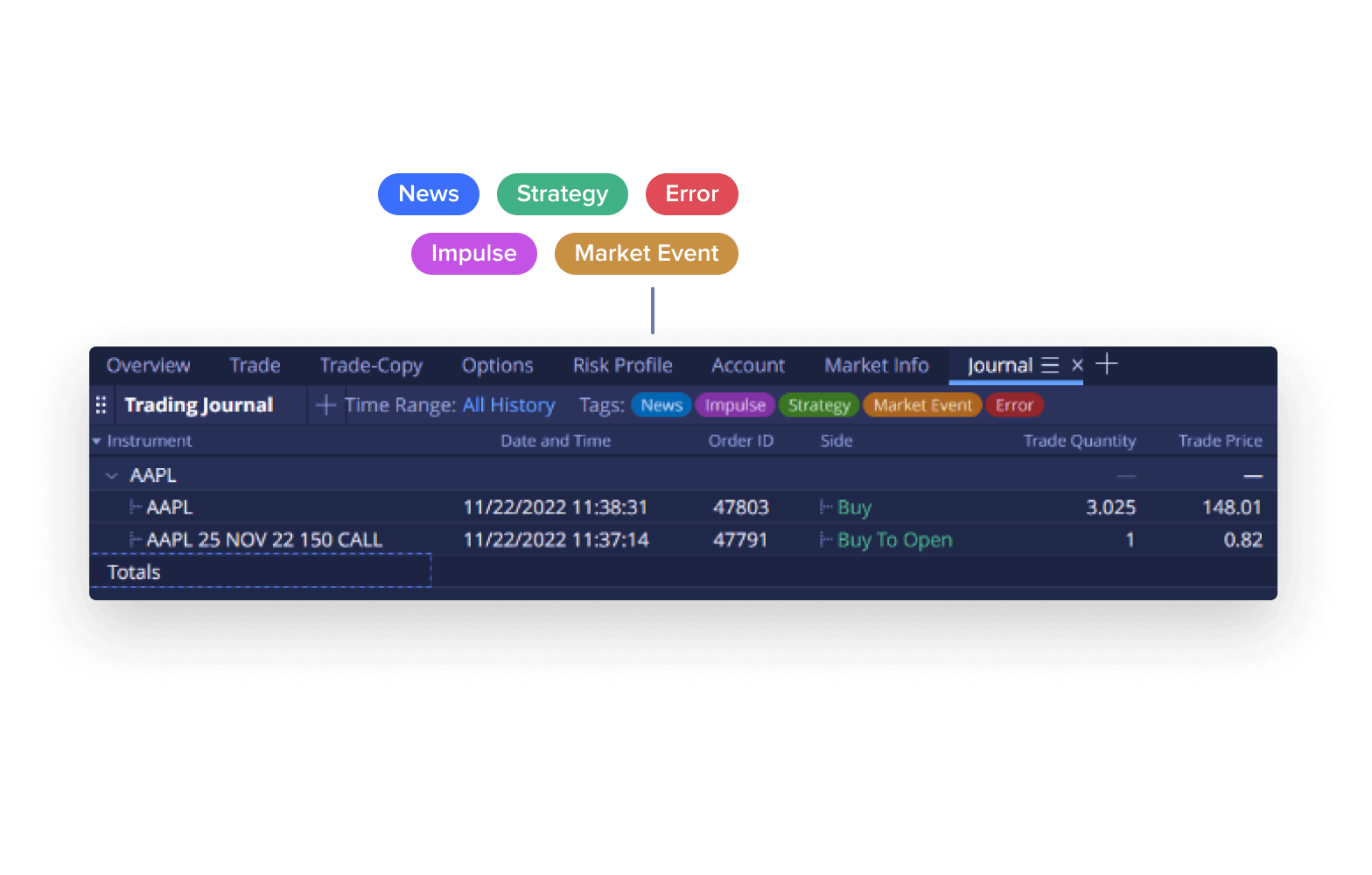

Trading Journal

To help clients manage their trading strategies and increase their engagement, DXtrade XT offers a Trading Journal. It allows clients to add notes to trades and positions on their accounts, as well as tag and filter them.

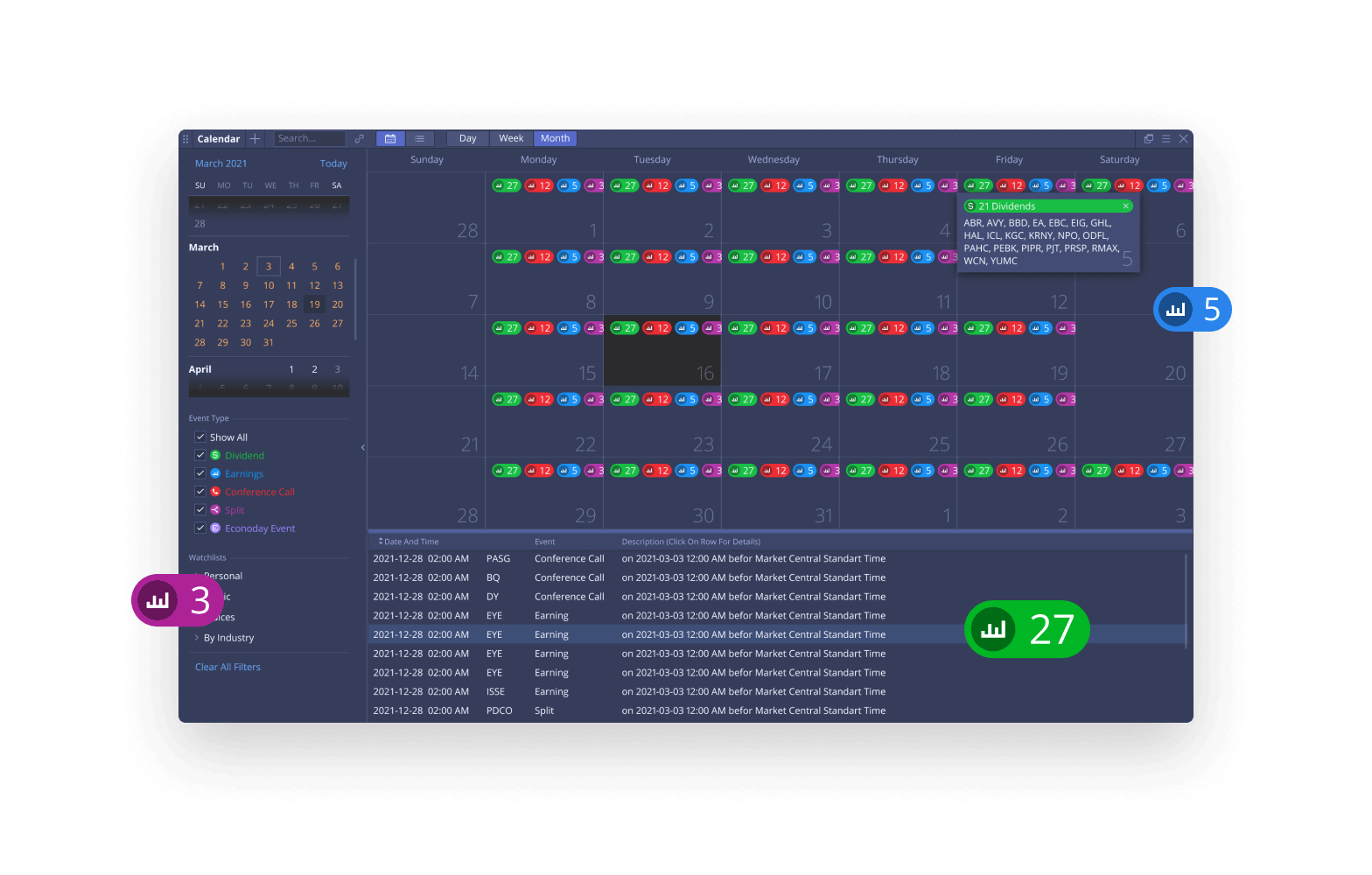

Calendar

A Calendar widget displays corporate data and events and provides clients with information on dividends, earnings, splits, and conference calls.

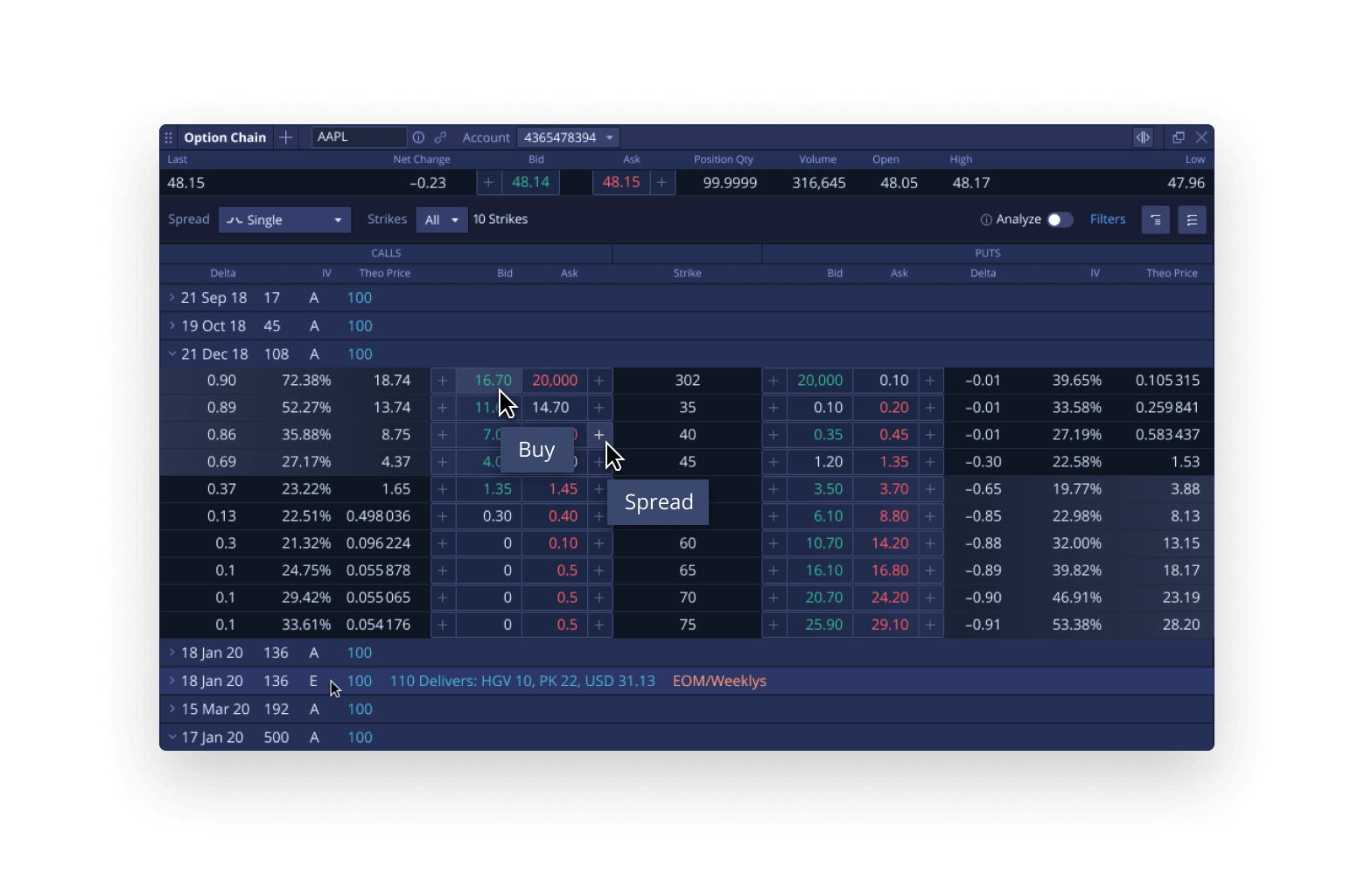

Option Chain

The Option Chain widget lists all options on an underlying instrument and allows viewing and filtering by strategy. This widget offers the capability to create simulated or planned positions and analyze them in the Risk Profile tool.

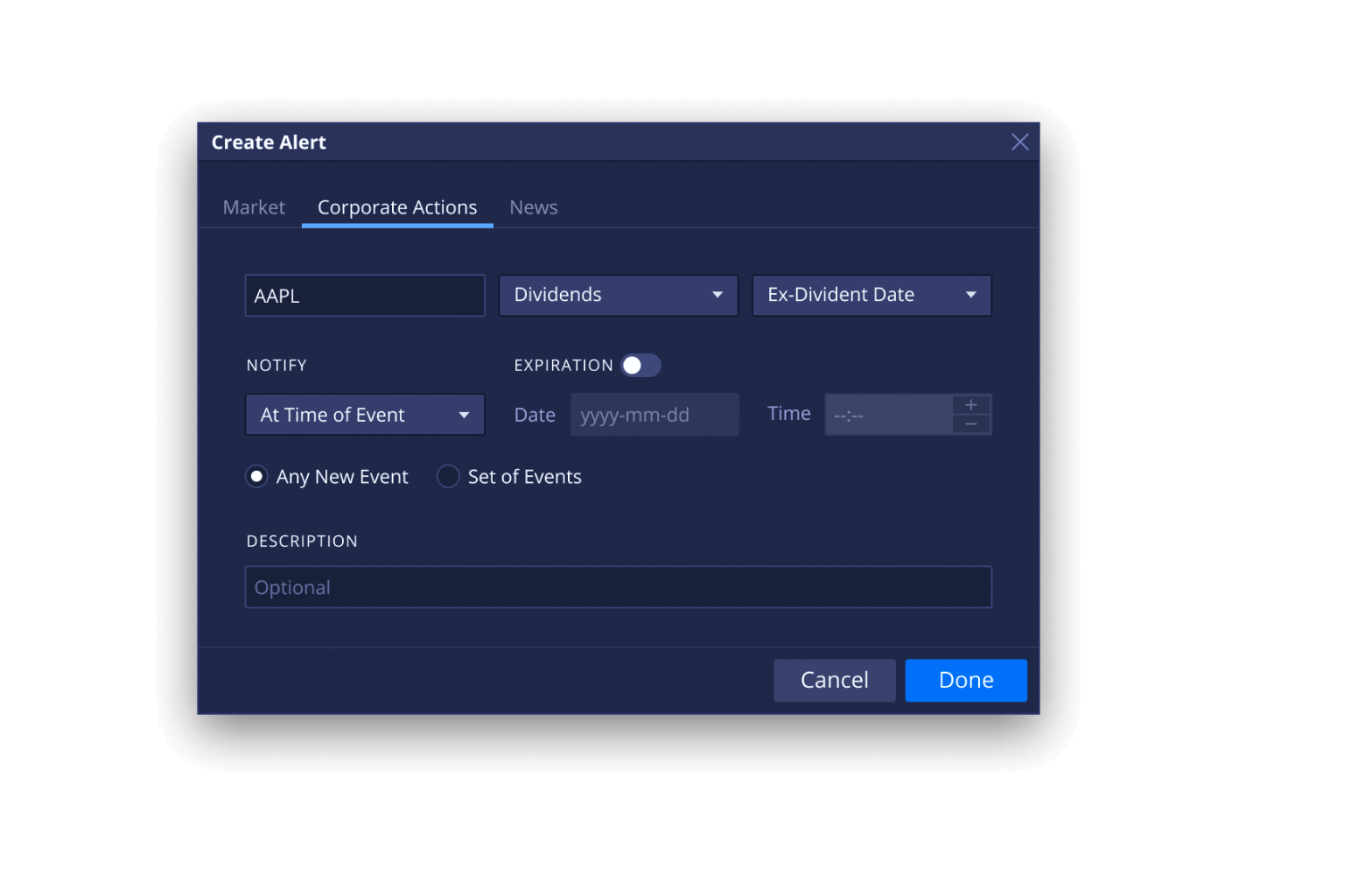

Price alerts

DXtrade XT offers configurable user alerts based on predefined characteristics including instrument, news, and calendar events. Clients can receive notifications via in-platform push messages, emails, and SMS.

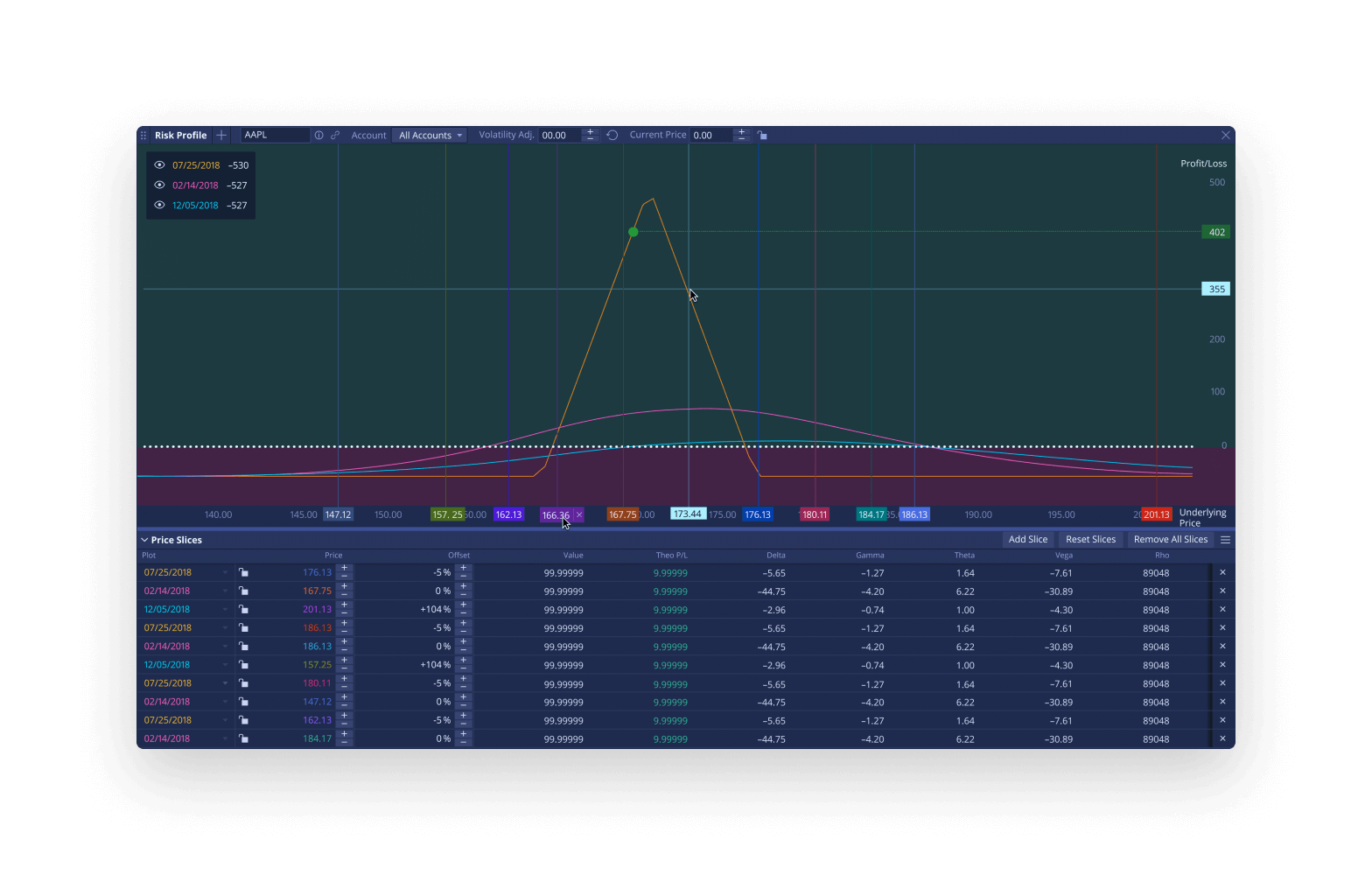

Risk Profile

The Risk Profile is a what-if analysis tool that allows traders to estimate potential P/L. It simulates changes to security parameters, such as price and volatility, to provide a time-based risk assessment.

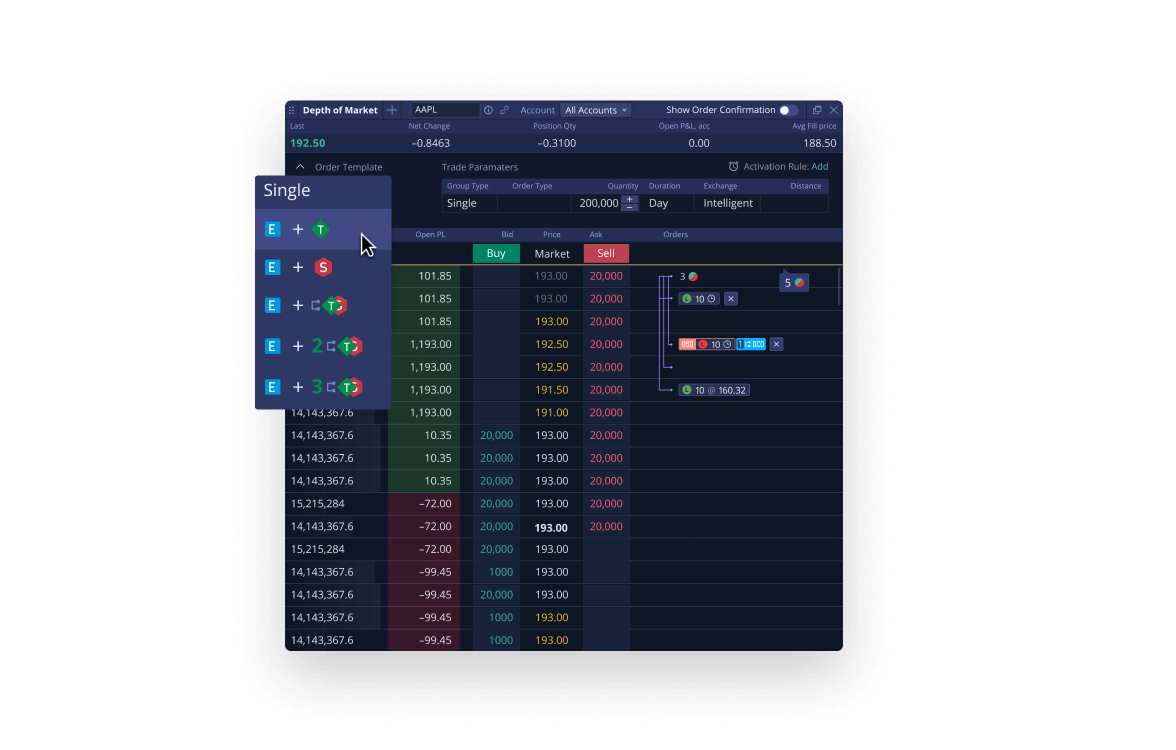

Market Depth

The Market Depth widget displays Level I and Level II data and the full market depth from connected exchanges for a selected instrument. Clients can filter visible levels (i.e. Top of the book, Regional best bid/ask, Full order depth), and the system highlights their pending orders and open positions on top of the current price levels in the Market Depth widget.