Futures Prop Trading Technology

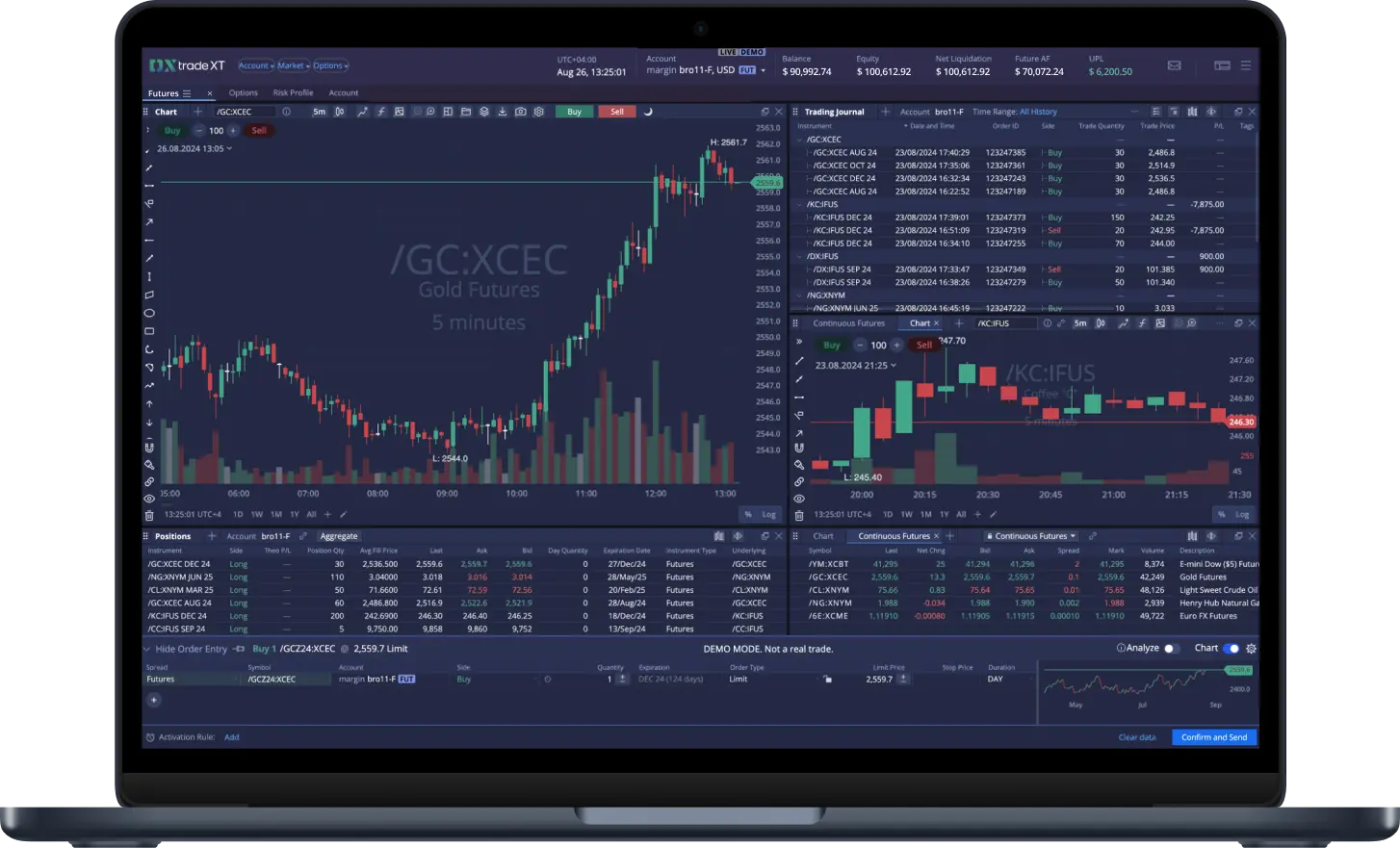

DXtrade XT is a modern, professional platform for futures prop trading and trading competitions

What is a futures prop trading company?

Futures prop trading firms evaluate traders using challenges, providing those who succeed with access to company funds for trading.

STEP 1

Creating challenges

for traders

- The company’s team formulates challenges encompassing diverse strategies, stages, financial goals, and risk thresholds to effectively evaluate traders.

STEP 2

Traders pay for

challenges

- Traders pay to participate in challenges, bringing prop firms additional income.

STEP 3

Sharing profits with

traders

- If traders pass the evaluation, they gain access to funded accounts to share trading profits with the prop firm.

Why DXtrade?

Benefits for prop firms licensing DXtrade XT

Our clients

Trading and risk management tools for your clients

Fractional trading

Brokers can manage their own fractional inventory or route orders to a supported executing destination, enabling affordable access to high-value assets.

This flexibility helps traders build diversified portfolios, driving engagement and accessibility.

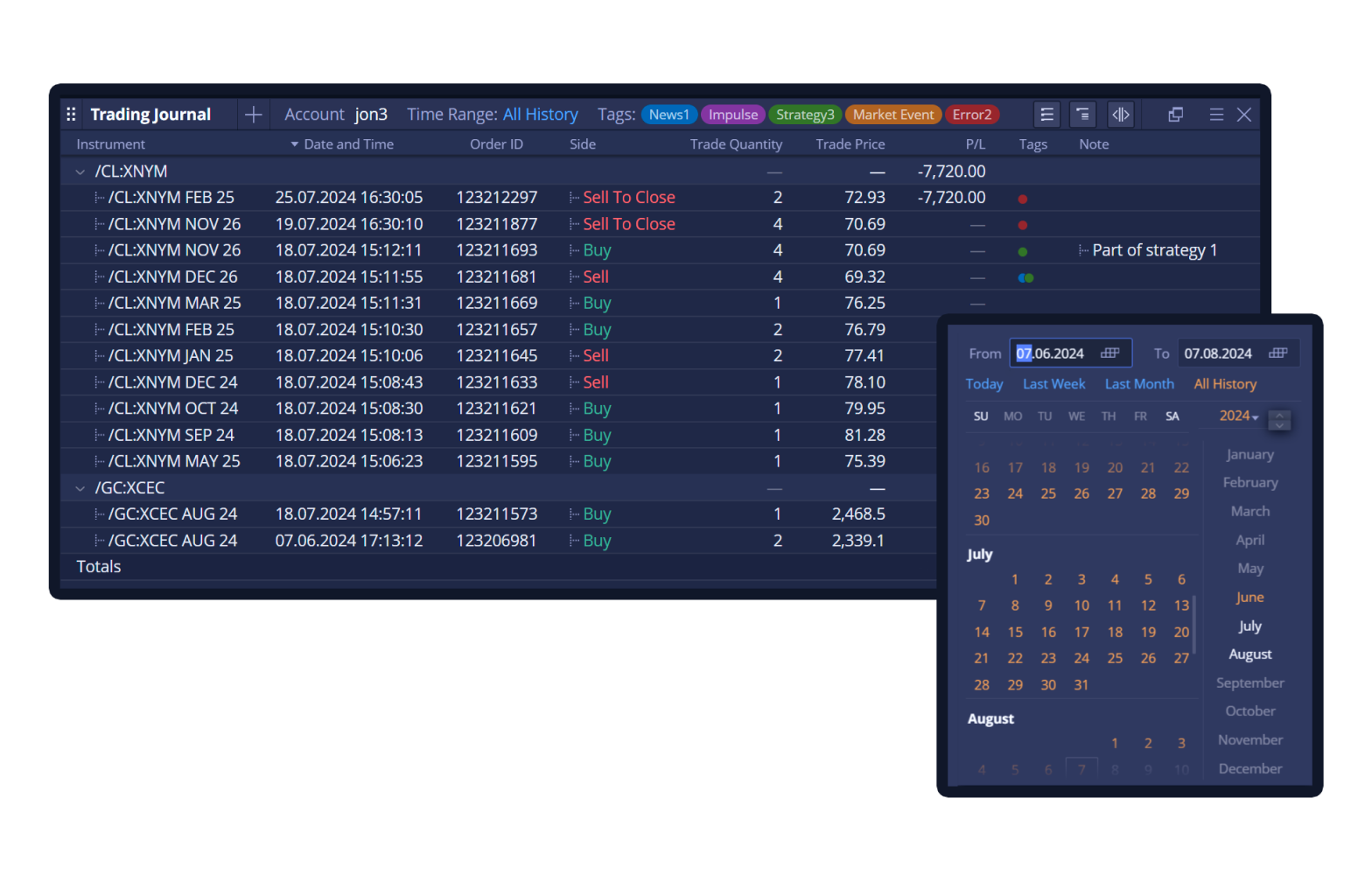

Trading journal

Increase client engagement and empower your traders to manage their trading strategies.

The trading journal enables clients to tag, filter, and add notes to trades and positions.

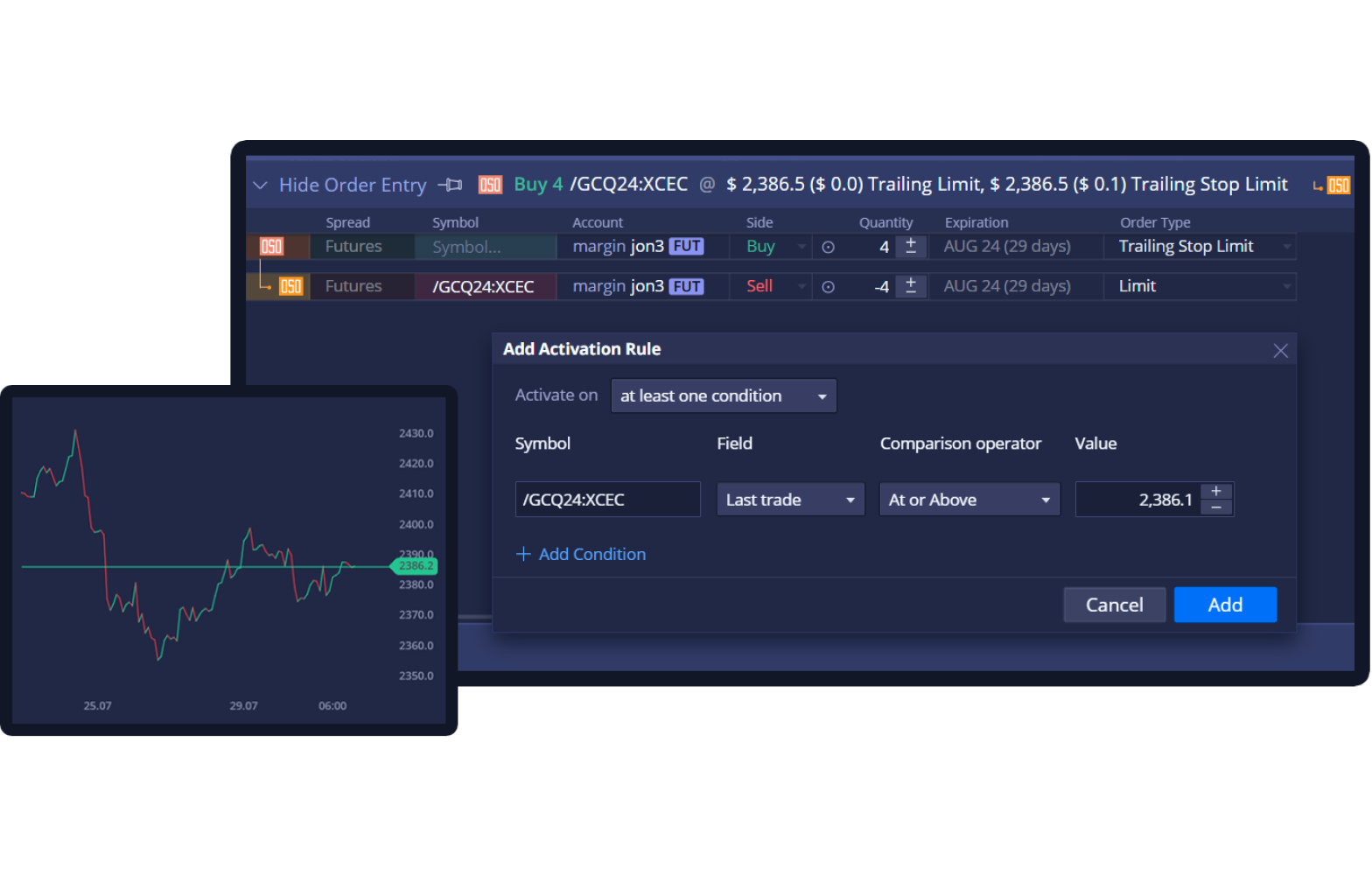

Various order types and position sizing

Help your clients control risk, offer flexible trading strategies and a variety of order types, such as stop market, stop limit, and trailing stop. Position sizing adjusts the number of contracts traded based on market volatility and a client’s risk tolerance.

Advanced charting library

Offer your clients custom watchlists and a quick search option to find trading instruments.

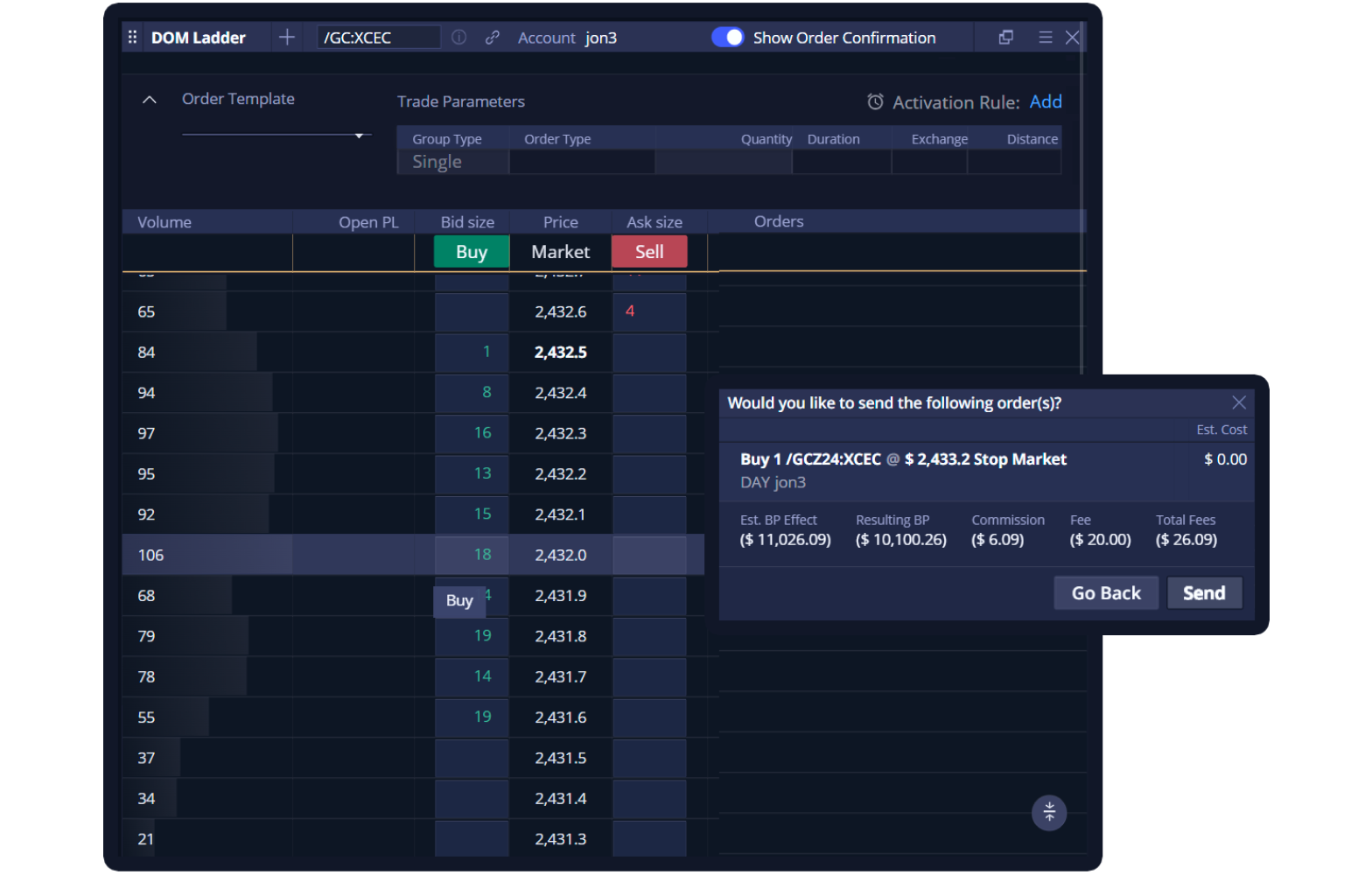

Market depth

Provide access to Level I and II data with the complete market depth from connected exchanges for a chosen instrument.

Clients can filter the displayed levels (e.g., top of the book, regional best bid/ask, full order depth), and the system will highlight their pending orders and open positions above the current price levels.

Features for prop firms and trading contests

Maximum account position limits

- Set the maximum trailing drawdown, the minimum amount of trading days, and the allowed number of open positions based on the packages you offer.

Auto-liquidation of positions

- Configure automatic liquidation of open positions at the end of a trading session.

Volume-aware

execution

- Fill orders partially based on available volumes and Level 2 data.

End-of-day trading configuration

- Set a custom schedule for opening and holding positions.

L1 and L2 feeds on a per-user basis

- Provide traders with flexible subscriptions to display Level 2 feeds.

Paper trading

environment

- A full-fledged trading simulator

- Launch client evaluations and trading contests

Managing traders

and operations

- Real-time monitoring of traders’ performance and adherence to the rules

- Support for account creation, transactions, group management