September is back-to-school time where DXtrade XT now gives your traders an option to go to the school of trading. This release is all about prop trading and helping brokers and prop firms launch challenges and contests. Play around and learn with DXtrade XT, and take a look at the release notes while at it.

Prop trading support

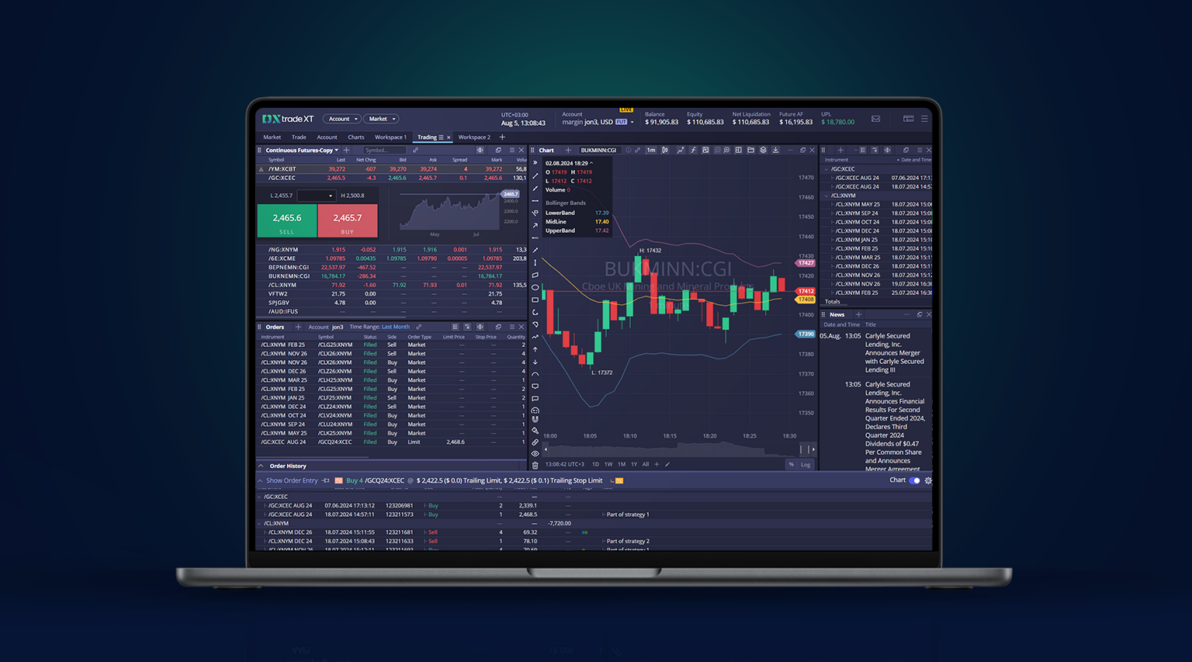

DXtrade XT has added enhancements and improvements to configure the platform for proprietary trading.

The supported instruments are CME (XCME) single futures. The DXtrade XT prop trading configuration allows prop firms to organize challenges and contests for their clients using DXtrade XT as a paper money trading environment.

Market data subscription management

The DXtrade XT prop trading configuration uses DXfeed as a provider of real-time market data. This release introduces the following market data subscription management process:

At the first login to DXtrade XT, users will be directed to the DXfeed onboarding dialog. DXfeed reports to the exchange and performs compliance checks. As soon as the user completes the onboarding, they are automatically redirected back to DXtrade XT. DXtrade XT then activates their dedicated CME subscription in DXfeed.

Users have to go through the onboarding process only once – the same login is used for each challenge ticket. DXtrade XT checks that the user is registered (i.e. their DXfeed subscription is active) on each login. If the subscription is not activated (i.e. onboarding is not completed), the user’s access to the paper money trading interface can be restricted.

Trading schedules

To accommodate prop firms with their specific schedules during which traders can open and hold positions, DXtrade XT now supports flexible adjustment of trading schedules. The trading schedule’s end time can be set individually for each firm.

Auto liquidation

In prop trading, traders have to close all open positions and orders before the end of the trading session or before the weekend. If a trader fails to do so, the prop firm can either liquidate their open positions and orders automatically at the end of the trading session or close their prop trading account altogether. To avoid this, DXtrade XT employs a full liquidation strategy that is triggered automatically at the end of the prop firm trading day. During this process, the positions are closed by closing orders, and other outstanding orders are canceled. The platform also automatically blocks placing other orders.

Notifications

DXtrade XT allows prop firms to send notifications to their traders in Web Trader or mobile app to alert them that the end of the trading sessions is approaching and they have to close their open positions. Alternatively, prop firms can disable notifications.

Volume-aware execution

In the process of simulated execution, orders are generally executed by Top of the Book prices. To accommodate the needs of prop firms, the DXtrade XT simulator is configured to execute orders as follows: in the majority of cases, the simulator uses Level 2 quotes with respective volumes to fill orders; Limit orders are filled only when the full order quantity can be filled against L2 liquidity, i.e. when the volume-weighted average price of these fills is better than or equal to the requested limit price.

After you’ve won a challenge or two, take your time and keep an eye out for the next DXtrade XT release. There’ll be lots of great stuff to unbox. In the meantime,

Stay tuned,

The DXtrade XT team