A forex brokerage is a complicated but potentially lucrative business. Whether you’re an aspiring forex broker or a novice who wants to thoroughly understand what you’re getting yourself into, read on—we’ll outline the basics of opening a forex brokerage.

We’ll tackle the topic in the following order: first, we’ll go over a timeline for starting a forex business, second, we’ll discuss the registration, regulation, and incorporation, evaluate costs, and provide software insights.

Possible paths to launch a forex brokerage

There are two main paths an aspiring broker can follow when starting an FX brokerage business. Their difficulty levels vary. Let’s review them and sort out all their pros and cons.

Becoming an introducing broker

The easiest way to hop into the FX brokerage business is to become an IB. This way, you’ll dodge the difficulties related to the technology and registration process.

Large FX brokerages offer franchise licenses to those willing to launch their dealing center under a trusted brand. By purchasing such a license, you can escape the whole trouble of dealing with technological and legal issues. Your main goal as an IB is to attract as many clients as possible and make a profit on commission.

Your executing broker has to provide you with access to a trading platform and infrastructure. As the name suggests, they will also execute and monitor your clients’ orders. What you need to remember is that all the clients you attract are legally the clients of your executing broker and that you have to pay a good chunk of your profit for the license and execution commissions.

| IB’s advantages | IB’s disadvantages |

| The most accessible way to enter the forex brokerage business | Full dependence on a primary broker |

| A trading platform, infrastructure, and integrations are provided by your primary broker, so you don’t have to worry about anything tech-wise. | You’re too exposed to risk: you’ll receive less commission if a successful client joins through your affiliate link and starts profiting. |

| Your only worry will be to permanently attract new clients. | You can’t pick and choose trading software or partners—you’ll have to accept whatever your primary broker provides you with. |

Getting a white-label trading platform

Another way to start is to open your own FX brokerage to be in control of all operations but get a white-label trading platform to reduce the tech hassle.

Let’s quickly review the pros and cons of this path and then elaborate on how to proceed if you choose this option.

| White-label advantages | White-label disadvantages |

| An FX brokerage business under your brand | Dependence on the software you choose |

| Low tech expenses: there’s an abundance of white labels to choose from, so you’ll be able to find a trading platform that fits your budget. | Scaling might be costly depending on the technology vendor you choose |

| No hassle with integrations and trading servers: your tech vendor will provide you with everything. | Not much room for customizations: white labels are almost always turnkey solutions that can’t be tailored to fit the needs of a broker that wants to go beyond a standard business model. |

| Full control of all operations: you’re the only decision-maker. | Although you get turnkey technology, you’ll need to tackle on your own all other steps of opening an FX brokerage: registration, incorporation, opening of bank accounts, etc. |

| You’ll go through each step of launching an FX brokerage business, which will allow you to understand it thoroughly. | Higher cost of entry to the business. |

How to launch a forex brokerage firm under your brand?

In order to establish your own forex brokerage firm you need a reliable execution plan.

Here’s a sample of an estimated timeline if you decide to use a white-label trading platform.

As you see, opting for a white-label solution allows you to launch an FX brokerage under your brand relatively fast.

There are many established companies more than willing to provide aspiring FX brokers with a trading platform and servers. They’ll also give you every technological aspect required to launch your FX brokerage business. The expenses on a white label are usually an installation cost and a monthly fee (either based on the number of clients or a trading volume).

If you’re interested in running an FX brokerage under your brand, let’s dive deeper into the process of opening such a business.

Step 1. Define the basics of your brokerage

Before incorporation, you need to work out your FX brokerage business model. Here are the basics:

Identify your target market

Determine the regions you plan to focus on, such as South America, Europe, Africa, Asia, etc. Your choice of target market will impact various aspects, including initial cash burn, marketing strategies, software requirements, registration, and incorporation process.

Select the asset classes you will offer

Decide on the asset classes you intend to offer, such as forex pairs, CFDs, spread bets, and cryptocurrencies. Expanding the variety of asset classes can enhance the appeal of your brokerage, leading to higher trading volumes and increased profits. Ensure that your chosen trading platform allows adding more asset classes as you grow.

Consider offering leverage to traders.

Decide whether you will offer leverage to your clients.

Determine your trade processing model.

The options are an A-book, B-book, or hybrid model. The trade processing model you employ has a significant impact on your potential profit. A-booking carries low risk but limited earnings because your only task is to send trades directly to liquidity providers for execution. Alternatively, a hybrid model involving a dealing desk allows you to process some orders internally. However, this model requires well-trained staff and robust software for a dealing desk and risk management.

Step 2. Incorporation, registration, and regulation

Incorporation

Selecting the right country for incorporating your forex brokerage demands careful consideration. Apart from the obvious factors like capital requirements, guarantee fund size, taxes, reporting, government fees, professional qualifications, background checks on you and your partners, and mandatory personnel, there are less trivial aspects to take into account, for example, whether a country may pose a threat to your business continuity due to geopolitical reasons.

Registration and Regulation

To make your forex brokerage a legitimate and trustworthy business, you need to register with a regulator. Which one to choose depends on your desired market. One of the most popular options is CySEC (Cyprus) regulation, which is suitable for targeting the EU audience.

For Asian markets, there are various options capable of accommodating different budgets. For instance, launching a regulated FX brokerage in Hong Kong requires a minimum investment of $650,000, ensuring a strong footing in the region. But it’s worth keeping in mind that mainland China does not permit margin trading.

If budget constraints are a concern, obtaining a license from Vanuatu (VFSC) is a more affordable and quicker option, but you’ll need to establish a physical presence in the country and find a local manager and director.

Once your brokerage is established, you can move forward toward expanding your market reach by obtaining additional licenses. A diverse regulatory portfolio allows brokers to benefit from improved trade leverage, marketing opportunities, and a wider array of trading instruments, attracting a broader trading audience.

Other affordable registration choices include the Seychelles forex license (FSA) with a $1,500 application fee and a $3,000 annual fee, and the Mauritius forex license (FSC) with a $3,000 registration fee and a $9,000 annual fee. However, the latter requires an approximate capital investment of $250,000.

Step 3. Find the right technology

Let’s get back to where we started: getting a white-label FX trading platform to cover your technology needs for launching your FX brokerage. As we mentioned, the market offers numerous options with varying pricing. But beware of seemingly cheap platforms—such solutions might come with hidden expenses for maintenance, support, upgrades, and additional features, ultimately leading to vendor lock-in.

Today, modern and flexible trading platforms eliminate the need for extra plugins like bridges, saving you money. Look for platforms seamlessly integrated with various third-party service providers, such as liquidity hubs, market data sources, payment services, and financial news feeds. Some platforms, like our DXtrade CFD, even offer valuable perks like chatbots for customer support, educational modules, copy trading functionality, and trading contests.

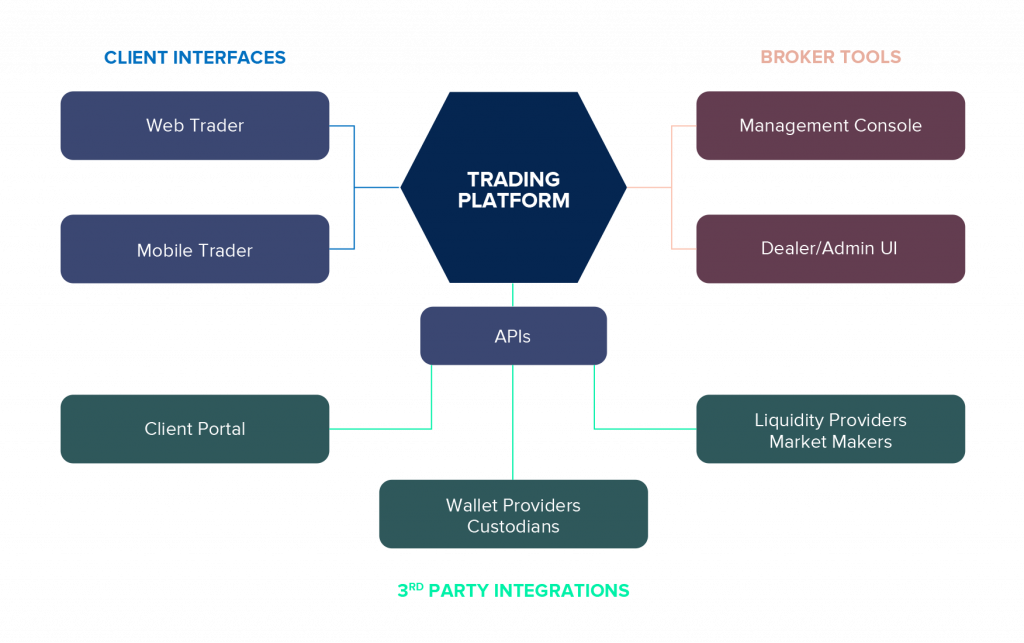

Ideally, partner with a technology provider that offers a comprehensive solution to kickstart your FX brokerage. The solution should include a trading platform, a dealing desk, an order management system, a CRM system, and a personal cabinet with integrated payment and KYC modules.

The vendor’s platform suite should also come with a modern mobile trading app, as most traders now prefer on-the-go trading. If a technology vendor offers a mobile app that you’ll own solely and have separate pages in app stores—even better, it’s a tremendous advantage for client retention.

When it comes to features, ensure that the platform you choose supports your preferred order processing mode, be it A-book or B-book, and offers risk management tools for in-house dealing desks.

Scalability is also vital for accommodating your business growth. As you become more comfortable with your starting package, you can expand your offering with new trading instruments, attracting more traders.

Some platforms, like our DXtrade CFD, facilitate this ambition. As your brokerage matures, you can add more trading instruments, get tailored widgets, and even opt for a custom trading platform. We also offer brokers to gain control over their business processes by buying out the platform’s source code to establish an in-house solution, reduce their risk exposure, and increase business valuation.

Side note: We’ve also published a handy infographic on how to start your brokerage.

Conclusion

Remembering numerous details can be overwhelming, but we haven’t even started covering the marketing and hiring parts! They deserve separate articles, so we’ll cover them later.

For now, if you set your thoughts on launching an FX brokerage, you need to diligently do your homework and research each aspect of the business. If you approach this goal right, soon you’ll be managing a profitable venture and catering to a vast community of traders.

At Devexperts, we specialize in developing all the necessary trading software solutions and doing the integrations you’ll need to start an FX brokerage. Partnering with us will free your time to concentrate on essential business aspects such as marketing, customer relations, and operations.