Broker-dealers working with exchange-traded instruments must always adhere to regulatory requirements to operate legally and keep their license.

We’ll delve into how DXtrade XT supports margin and cash accounts, facilitating seamless compliance with Reg-T while empowering brokers and investors alike.

Understanding margin accounts

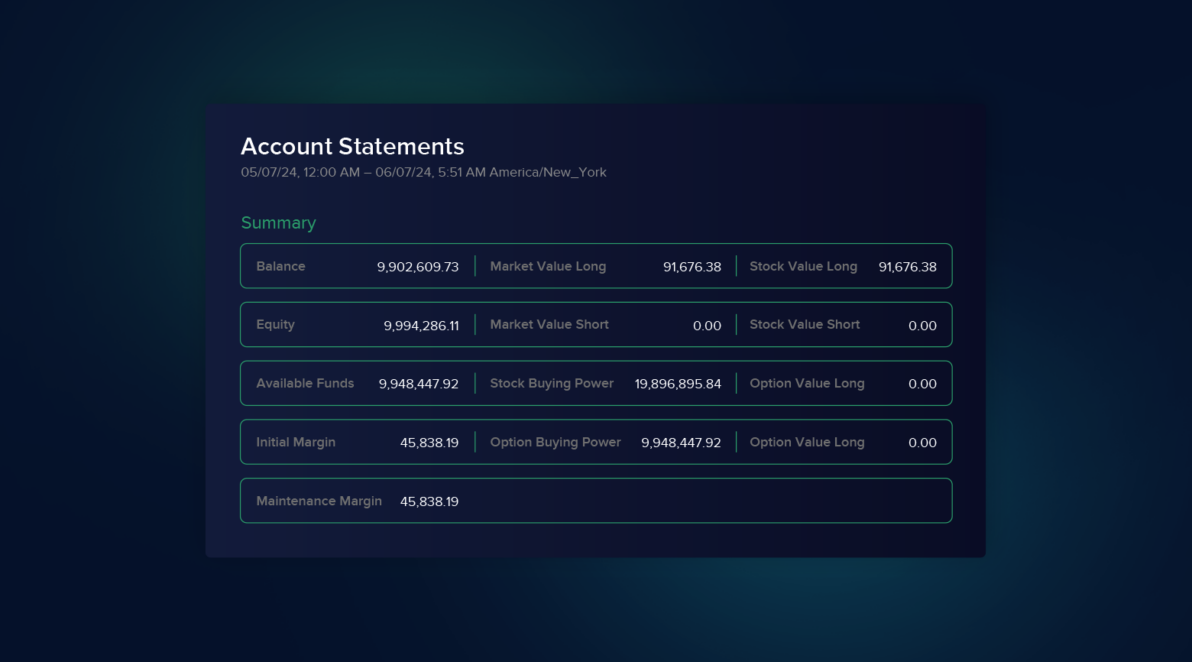

DXtrade XT supports margin accounts for multiple underlying asset types, catering to the diverse needs of investors seeking leverage and enhanced trading capabilities. Let’s explore the key features and functionalities:

- Reg-T margining: DXtrade XT facilitates Reg-T margining for equities and equity options, ensuring adherence to regulatory standards while enabling investors to leverage their positions responsibly.

- Trade cycle compliance: Cash accounts operate within the framework of the T+2 and T+1 rules, meaning that the settlement date occurs two business days after the trade date or after one business day according to the new settlement cycle in force since May 28, 2024. This adherence to trade cycle regulations ensures transparency and accountability in trade settlements.

- Short selling restrictions: In compliance with the US regulatory guidelines, cash accounts on DXtrade XT do not support short selling, thereby mitigating risks associated with speculative trading practices.

- Pattern day trader (PDT) compliance: The platform tracks the number of day trades per account and systematically marks and restricts investors who meet PDT qualifications if they do not maintain the minimum balance requirements.

- Custom margin profiles: Brokers can establish personalized margin profiles to align with their risk preferences and regulatory obligations. Additionally, instrument-level margin overrides provide an added layer of flexibility, allowing for either manual adjustments or automated updates through reconciliation files. This comprehensive approach empowers brokers to fine-tune their margin requirements to best suit their needs and operational processes.

Operational efficiency and compliance

DXtrade XT goes beyond mere compliance, offering operational efficiency and enhanced control over trading activities. Here’s how:

- Minimum equity requirements: DXtrade XT empowers brokers to set and enforce minimum equity requirements for PDT accounts (at least $25,000 in a client’s margin account according to FINRA and the NYSE rule), ensuring compliance with regulatory mandates and promoting responsible trading practices.

- Operational сontrol: With operational controls to mark or unmark accounts as PDT based on order history, brokers have the flexibility to adapt to changing market conditions and regulatory requirements.

Empowering compliance and efficiency

DXtrade XT is a reliable platform that ensures regulatory compliance and efficient support for margin and cash accounts. It empowers brokers to confidently navigate regulatory requirements and promotes responsible trading practices.

Ready to get started? For more information on DXtrade XT, contact our experts.