As we are heading into the very depths of the fall, traders’ profits continue to rise. Enjoy trading from the comfort of your home or office while it’s raining cats and dogs (or bulls and bears, anyone?) The new release of DXtrade XT got you covered with lots of improvements related to market data subscriptions and handling futures and the integration with StoneX, a leading clearing provider. Read on to learn more!

Web Trader

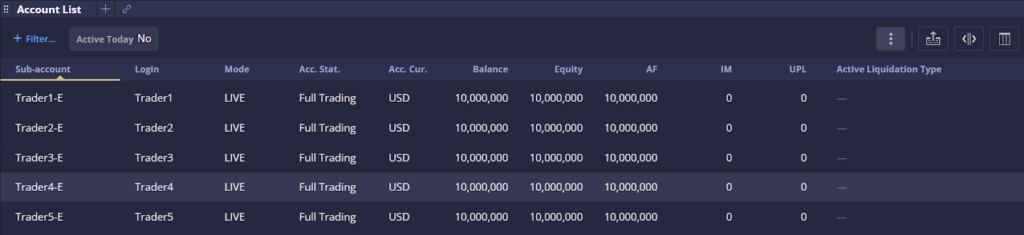

List of market data subscriptions shown to traders

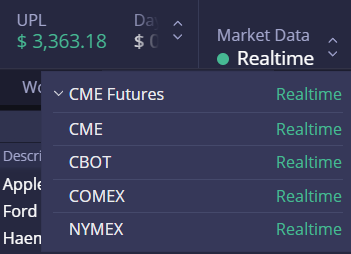

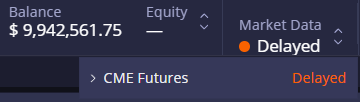

Traders are now able to view a current list of their market data subscriptions. Realtime and delayed market data feeds are explicitly highlighted.

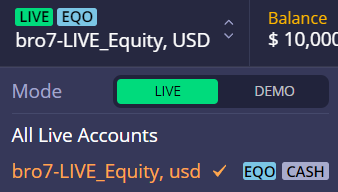

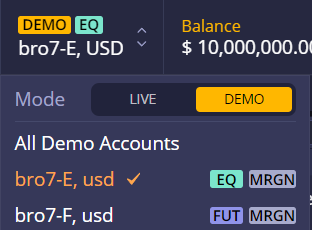

Demo/Live switching UI improvement

For this release, we have made switching between live and demo UI environments more explicit so that the user can address regulatory requirements.

Web Broker

Auto-liquidation of physical settlement futures: UI improvements

To prevent the delivery of physical settlement futures, previous releases implemented a special auto-liquidation feature. This auto-liquidation cancels all orders for the expiring instrument N (configurable) days before the Last Trade Date and automatically closes positions.

In this release, we have introduced several UI and usability improvements:

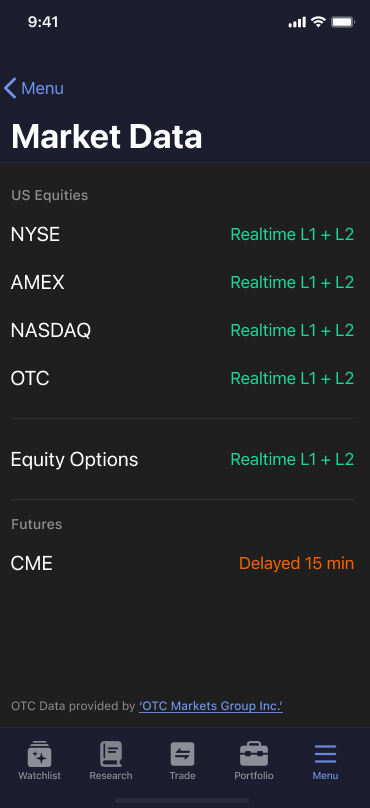

Account List:

- An “Active Liquidation Type” column has been added. Liquidation of futures positions by physical settlement is now displayed.

- The “Stop Liquidation” operation can be applied to physical settlement liquidation.

Order Book:

- Liquidation orders for futures positions by physical settlement are now shown in the Order Book. The corresponding order type is also shown in the “Liquidation” column.

- The closing mode for an expiring instrument is calculated analytically now (not a specific instrument status, as before).

Mobile

Quick Close with Market functionality

For this release, we have added the “Quick Close with Market” functionality to the Position Details page in the mobile app. This feature enables traders to close a position quickly by placing a market order for the full position quantity. For consistency, the system first cancels any existing orders for the instrument before executing the market order.

Equity-to-Margin ratio metric and liquidation support

Futures liquidation is now fully supported in mobile apps. In this release, Equity-to-Margin ratio metric has been added to the mobile environment, and liquidation messages have been localized into all supported languages.

To learn more about the liquidation approach we implement for futures, go to the StoneX Risk Management section below.

List of Market Data Subscriptions Shown to Users

Traders are now able to view the current list of market data subscriptions. The list can be found in Menu > Market Data Status > Market Data.

Market data subscriptions

Delayed data for demo accounts

This release supports the delivery of delayed market data in both Web Trader and the mobile app for demo accounts, that is, in cases where a trader has no live accounts and no market data subscriptions. If a trader has at least one live account but no market data subscriptions, they will be redirected to the market data provider subscription form.

Realtime vs delayed and L1/L2 feeds on a per-user basis

As a rule, if a trader does not have access to real-time market data, delayed market data should be provided for such widgets as Watchlist or Chart. Exchanges that provide the data are legally bound to inform users about delayed data. To address this, the system has been updated to explicitly show the type of market data available to traders. For this purpose, L1/L2 subscription flags have been added to DXtrade XT. Using this flag, admins can show or hide L2-specific widgets for specific users depending on whether they have an L1+L2 subscription or not. The users are now also explicitly shown whether their account receives real-time or delayed market data feeds.

StoneX integration

To support the integration with StoneX, we’ve added to our platform risk measurements for futures used on the StoneX side. We have also introduced new thresholds to track sufficient buying power for futures accounts.

Minimum Net Liquidation thresholds have been expanded:

- It is now possible to set a separate Minimum Net Liquidation threshold for accounts trading exclusively in MICRO PRODUCTS.

- The system will initiate full liquidation if the Minimum Net Liquidation threshold is breached by the user.

- Trader orders will also be checked pre-trade for this metric, helping admins prevent unexpected account liquidations.

New Equity-to-Margin ratio metric has been introduced:

Equity-to-Margin ratio is calculated by dividing the user’s Net Liquidation value by Initial Margin (IM). Minimum Equity-to-Margin threshold has also been included to enable the system to trigger full liquidation in case the minimum Equity-to-Margin ratio is breached for an account.

StoneX reconciliation

To facilitate integration with StoneX, this release supports the reconciliation of positions and balances based on StoneX reconciliation files. Disclosed mode is supported, and discrepancies, if found, will be recorded in the Reconciliation Job Log and Break Report file.

Futures support: Margining and expiration

Intraday/overnight futures margin rates

For this release, we’ve added support for intraday/overnight futures margin rates. Two new fields have been added to Product Instruments (Intraday %% and Overnight %):

- Intraday Rate defines the discount for all product-related futures during the specified Intraday Period.

- Overnight Rate defines the margining for a futures instrument beyond the Intraday period. To address the volatility of specific products, overnight percentage values can be higher than 100%.

If no Intraday/Overnight rates are specified, Initial Margin and Maintenance margin rates will be taken as is.

Cash settlement futures expiration support

Considering that future expirations are reflected in cash, it is a general practice to keep such positions on account until expiration. This release allows brokers to do just that, however, all trading after the last trading day is blocked.

Physical settlement futures expiration support

Most futures brokers who offer physical settlement trading provide no real physical settlement services. To address this convention, the DXtrade XT platform now ensures automatic liquidation of positions with such instruments (including non-executed orders) before the last trading day. The system also blocks executions of new positions issued from Web Trader with the same instruments on a date close to the settlement date.

We also have insider information that the next DXtrade XT release is going to be really big. It is likely that the system will expand further into the “Multi Currency Multi Asset” territory. Check back next time to find out if our insider tip was correct. Who knows, maybe it was just the tip of the iceberg. And in the meantime,

Stay tuned,

The DXtrade XT team