Late fall is the time for DXtrade CFD/Crypto to shine bright, helping you to get the much-needed sunlight. We’ve prepared a holiday box of useful features so that you could trade to your heart’s content before the holiday season. Read on to learn more!

Integrations

Integrations with third-party providers and tools to enhance the DXtrade CFD functionality.

Integration with TradingView: Advanced TV charts

The DXtrade platform now supports TradingView advanced charts. With this integration, users can leverage TradingView’s powerful charting tools, including a wide variety of technical indicators, and advanced drawing features. These capabilities offer traders more in-depth market analysis and enhanced flexibility for better-informed decision-making. TradingView charts also deliver a highly interactive and smooth experience, making it easy to track and respond to market movements in real time.

What’s in it for brokers?

Additionally, brokers can now choose between two charting solutions: TradingView and Devexperts’ proprietary DXcharts. This gives brokers the freedom to tailor the trading environment to best suit their clients’ needs, whether they prefer the industry-leading features of TradingView or the rich functionality of DXcharts. Both options provide customizable charting experiences with flexibility and precision in market analysis.

Web

New features in the web trading terminal.

Updated DXcharts

The new release of DXtrade comes with a fresh version of DXcharts, packed with numerous improvements to enhance the charting experience. The new release adds a new Volume by Price Drawing Tool which includes Range Volume Profile and Anchored Volume Profile. With these tools, traders are free to visualize how much volume exists at specific price levels. These drawings are a great help in identifying current and estimating future support and resistance levels.

What’s in it for brokers?

This update adds another helpful tool to the DXcharts drawing array. Advanced analytics tools are a proven way of increasing customer satisfaction and helping your clients trade more effectively.

Radar & Heatmap widgets

Two new widgets have been added to DXtrade CFD: Radar and Heatmap. These widgets are natively powered by dxFeed market data.

The Radar widget merges stock and OTC market tracking into a single interface, allowing users to easily switch between asset classes and access relevant symbols and real-time data. With advanced filtering options and tailored market insights, this all-in-one tool simplifies the process of monitoring diverse financial markets, making it easier to spot and evaluate trade opportunities.

The Heatmap widget allows traders to visualize market fluctuations through diverse data points. Moreover, it enables symbol color grouping based on Morningstar Sector classifications, offering a structured and informative perspective on market sectors.

User lock-out

To enhance security and protect against brute-force attacks, we have introduced an automatic user lock-out mechanism. When a user attempts to log in multiple times with incorrect credentials, their account will be locked as a precaution to prevent unauthorized access. Administrators can unlock accounts through the DXmc console. This update also includes improvements in error messaging for both web and mobile platforms, providing users with clear feedback during the lock-out process.

What’s in it for brokers?

Enhanced security measures increase trust in the platform users, thus increasing retention. Traders prefer to stay with platforms that keep their funds and personal information safe, and with these new precautions, brokers will be able to give them just that.

Mobile

Mobile app enhancements.

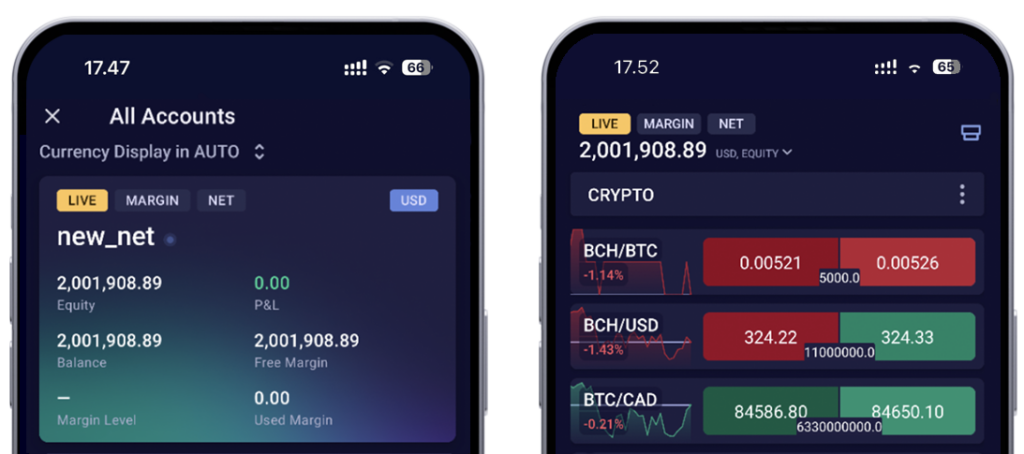

Net-based trading support

DXtrade CFD mobile apps now fully support the Net-based accounts trading model. All related screens display net position data properly.

One-time login

Users will now only need to log in only once after the application installation. The app will no longer prompt for credentials on subsequent uses, making access more hassle-free. Additionally, PIN code and biometric authentication are now optional, giving users more flexibility.

What’s in it for brokers?

This feature is optional, and brokers can choose to enable it. However, if your brokerage requires a stricter authentication process, a one-time login can be safely disabled.

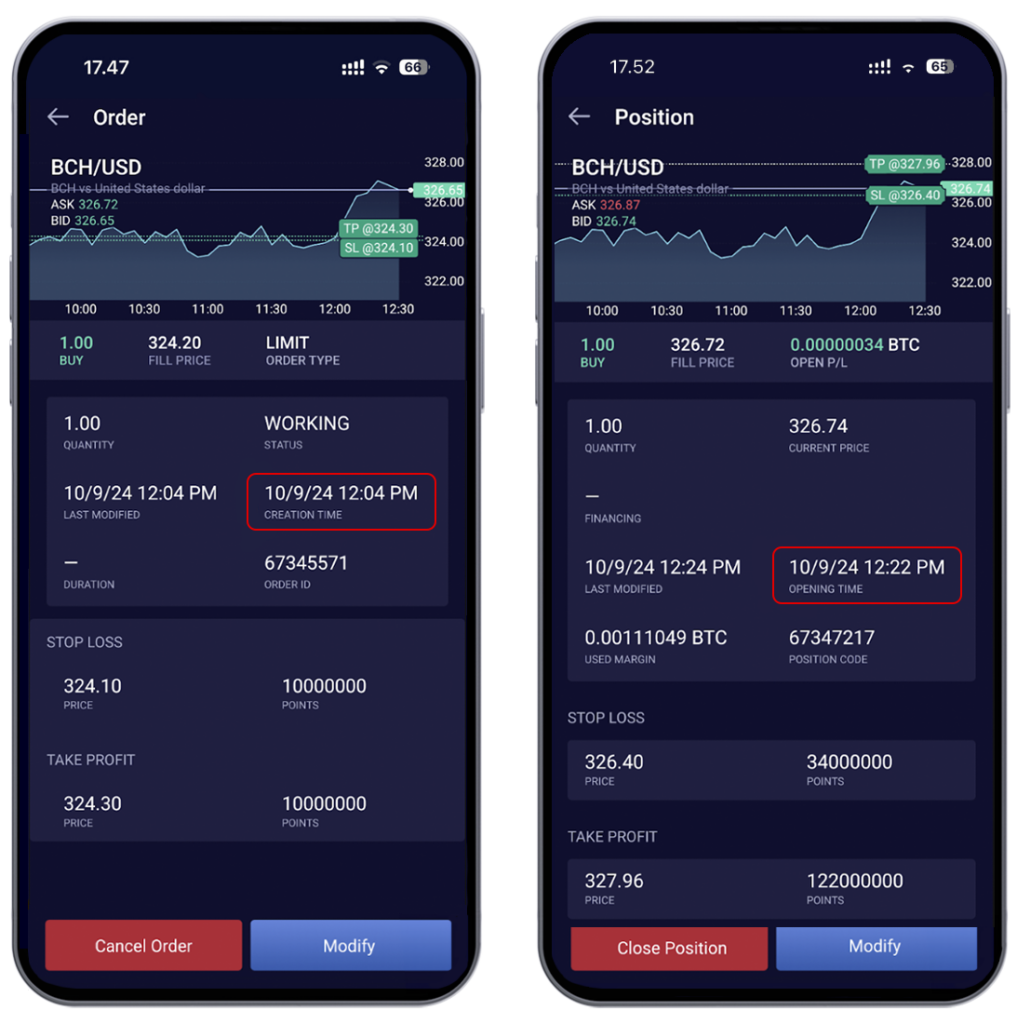

Stop-Loss/Take-Profit prices displayed on mini charts

In this release, traders will be able to see SL/TP of a position/order on the Instrument Details, Position Details, and Order Details screens.

Additional Firebase metrics

For this release, we have implemented additional Firebase metrics, Including Screen View Measurement.

What’s in it for brokers?

Now brokers can see how much time different groups of users spent on every particular screen and what the user flow is or was during specific periods.

Opening and creation time for Positions and Orders

We have added two new metrics for Order/Position screens. Traders can now see the opening time of a position, as well as the creation time of an order.

Management console

New features in DXmc, the DXtrade CFD/Crypto admin UI.

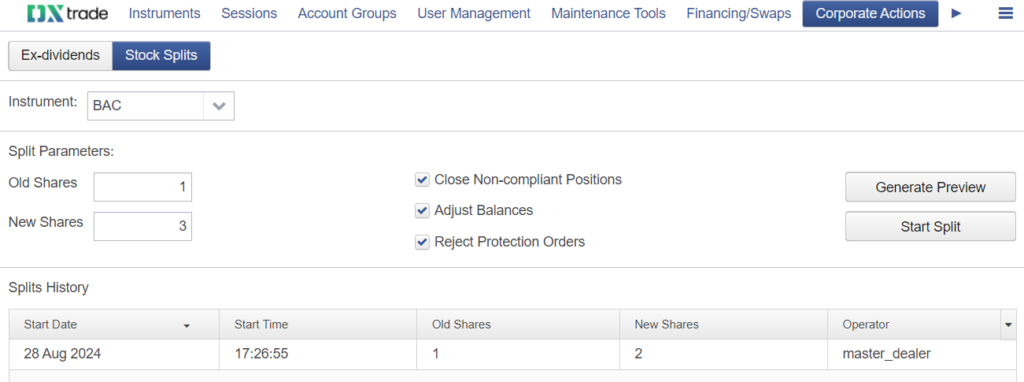

Stock splits

The system now provides support for stock splits. Split events must be scheduled in advance using manual input in the DXmc administrative UI. Admins are also free to generate a split preview, offering a detailed list of positions to be split and the prospective outcome.

Partner groups

In this release, we have introduced a long-awaited solution for creating infrastructure for B2B business models. Now, partner brokers can be separated into individual user groups on the same platform. Going forward, partner group management will be handled directly by the brokers, allowing them to create sub-groups of client users and manage them with dedicated dealer accounts.

Risk management

Additions to the desktop dealing desk application.

Reject orders in executing status by timeout

The processing of orders sent for external execution as part of FX-STP strategies has been significantly improved. It now includes the capability to reject initial client orders if the hedging part is stuck with no execution. The timeout for rejection can be defined in the back-end configuration on a system-wide level.

Leverage for proprietary accounts

Previously, all generic margin checks and pre-trade validations were disabled for the proprietary accounts. In this release, the regular margin trading pre-trade validation has been added to prevent prop accounts from exceeding standard margin requirements on order placing and modification.

Reports

New and improved broker reports

Tick Data report

This release comes with a new Tick Data report that allows to see the pricing history on the platform.

Broker stats report

Weekly reports with useful stats such as notional volumes, account numbers, daily orders, etc. can now be automatically sent by email. This report is provided for informational purposes, not for billing.

Money flow report improvements

The Money flow report now supports output in Excel format and shows the negative balance correction transfers.

API

EOD Account Metrics API

For this release, we added an endpoint that allows platform users to fetch end-of-day snapshots of account data metrics. Integrating parties can now request data such as account balance, equity, realized and unrealized PL, commissions paid (and many others) in a much simpler way.

Reliable Event Delivery API

This release brings a new way to receive asynchronous updates from the trading platforms. The new API relies on the AWS SQS messaging technology to stream updates in a scalable way.

With a simple HTTP-based language-agnostic interface and ready-made SDKs for multiple technical platforms, AWS SQS allows for efficient data retrieval without the need for polling-based reconciliation.

To simplify integration, DXtrade’s SQS-based API delivers exactly the same messages as the existing Push notifications API in the same JSON format. No subscription management on the client side is required: all the data will eventually be delivered.

This is not nearly all for this release. We have also included about 20 smaller improvements and fixed some bugs (well, you might not have noticed them, they were so tiny and unobtrusive). Our LP roster now includes 15 liquidity providers (with Velocity Trade as the latest in the mix). And we have even bigger plans for the future with cooler features, new integrations, and even better looks.

Stay tuned,

The DXtrade team