As November arrives, our DXtrade CFD/Crypto is ready to show its bright and vivid colors, much like the late autumn foliage. We’ve invested considerable effort in refining and enhancing our platform to make it shine in all its seasonal splendor. Alongside these refinements, we’re thrilled to introduce some fresh and exciting features in this release. Keep reading to explore the details.

Integrations

Integrations with third-party providers and tools to enhance the DXtrade CFD functionality.

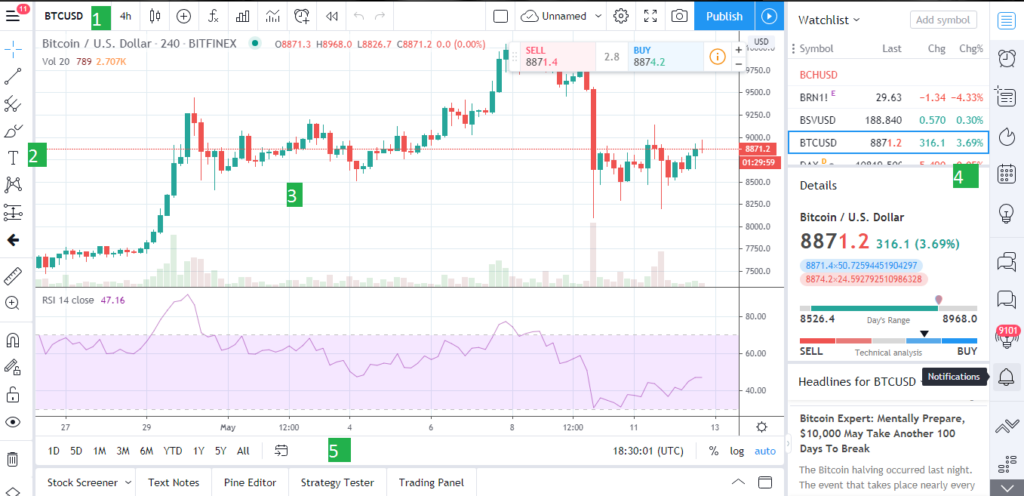

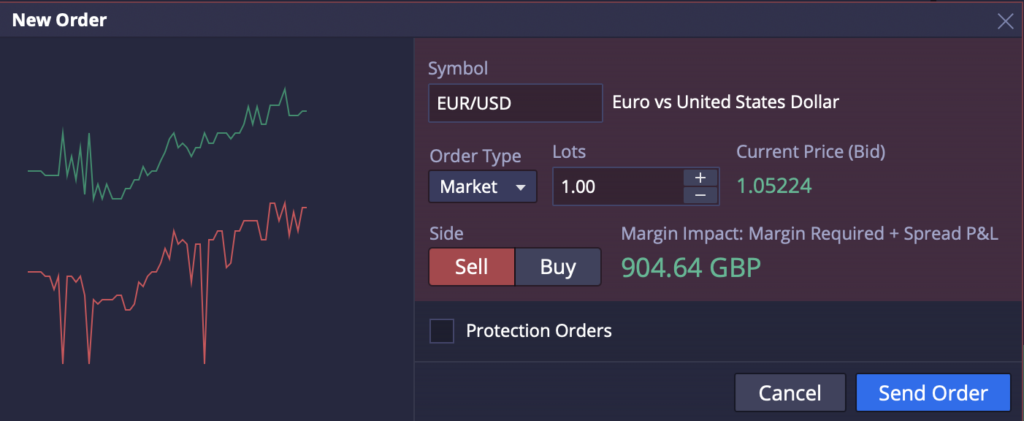

Integration with TradingView

Starting from this release, DXtrade CFD has been integrated with the TradingView trading interface. DXtrade can serve as the back-end for TradingView front-ends providing order and trade management, pricing, risk control, and reporting capabilities.

What’s in it for brokers

This integration helps brokers offer user-friendly access to DXtrade platforms to those traders who are more used to TradingView user interfaces. Traders will enjoy the comfort of a familiar environment while able to access the original DXtrade UIs at any time. Brokers, in turn, can tap into the established TradingView user community to attract new clients.

Integration with Devexa

DXtrade CFD is now seamlessly integrated with Devexa by Devexperts, an AI-powered virtual assistant and chatbot that provides support, news updates, and trading signals.

What’s in it for brokers

Thanks to the inclusion of Devexa, brokers can now offer their traders round-the-clock AI-powered assistance switching to full-scale support with audio, video, and screen-sharing capabilities. As a cherry on top, the Devexa widget UX can be fine-tuned by brokers to match their own DXtrade CFD look.

Web

New features in the web trading terminal.

New DXcharts

In this release, the charting within DXtrade CFD has been significantly upgraded and now harnesses the powerful DXcharts library. This update introduces a plethora of new improvements and features including:

- More chart types: Six new chart types have been introduced to give traders greater versatility: Area, Heikin-Ashi, Scatter, Hollow Candles, Histogram, and Baseline.

- More indicators: Six new indicators have been incorporated providing traders with additional tools for analysis.

- Even more drawings: The number of available drawings has been increased from 13 to 42. Each drawing now features both Magnet mode (for precise alignment with candle elements) and the sticky Drawing mode (for creating multiple drawings of the same type in a row). Moreover, Clear All Drawings and Hide All Drawings actions are now available.

- Snapshots: Users can now capture snapshots of charts and save them locally or copy them to the clipboard for convenient sharing.

- Revamped Settings: The Chart Settings and Price Scale Settings have been overhauled to offer a cleaner look and introduce new features enhancing user experience and customization.

What’s in it for brokers

Brokers can give their traders a user-friendly and accurate analysis tool to increase customer satisfaction. If included, advanced analytics go on to show that brokers are paying attention to traders’ needs and want to help them trade more effectively.

Web Trader UI Cleaned Up for Spread Betting

The DXtrade web trading platform UI has been modified to accurately illustrate the nuances of Spread Bet trading. Now, the Instrument Info widget, watchlist, pop-up notifications, and trading dialogs display SB-specific details more clearly.

What’s in it for brokers

Spread Betting appeals to a wide range of traders, from novices to experienced professionals. Brokers can tap into this diverse market and potentially expand their customer base.

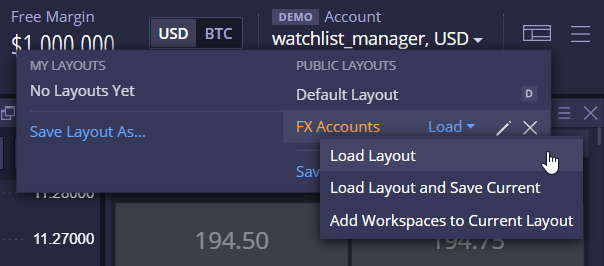

Public Layout Editing

Custom web trader layouts can now be created and edited by brokers in the DXdealer application. What is more, they can also modify the default layout to some extent, i.e. adjust what widgets to display and where to place them.

What’s in it for brokers

Brokers can now give their traders the long-awaited feature of modifying public watchlists and adjusting them to their preferences.

Mobile

Mobile app enhancements.

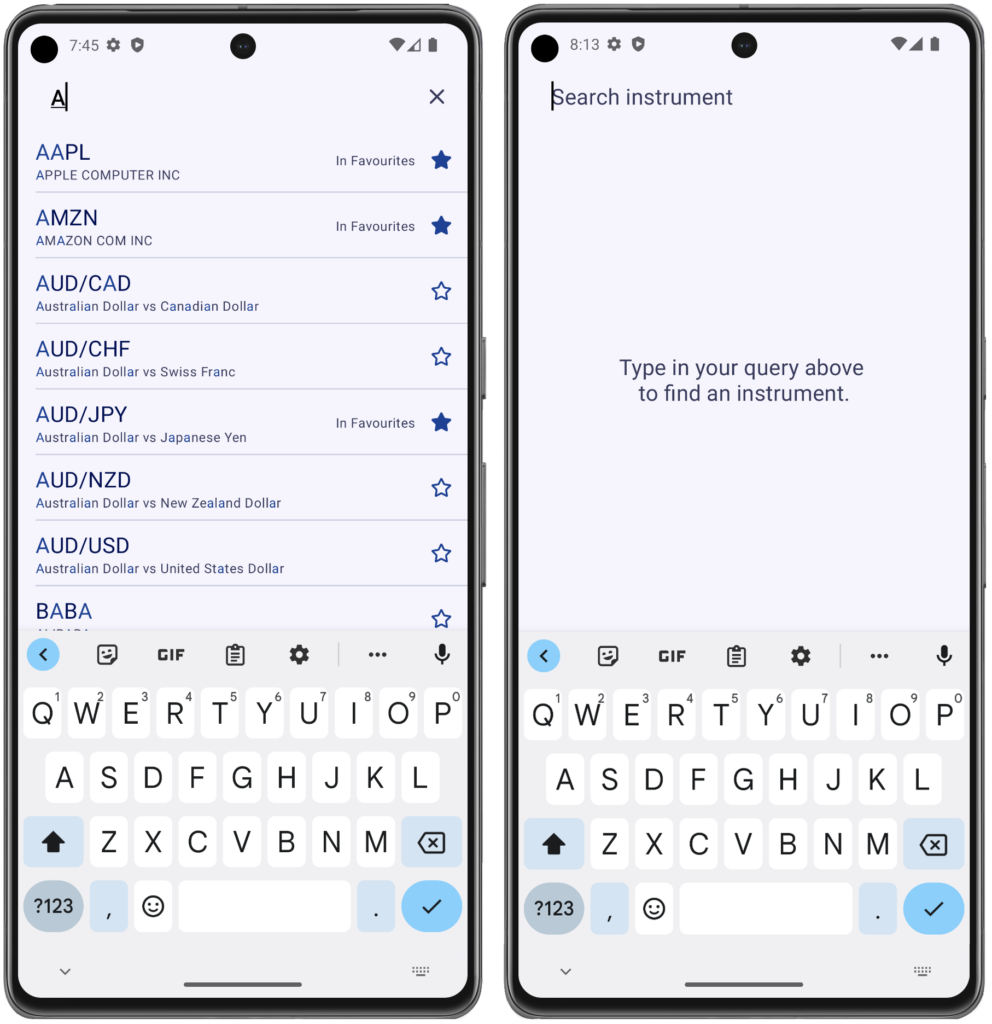

Search Screen Improvements

In DXtrade CFD, instruments can be added to the “Favourites” watchlist directly from the Search screen. Some UX polishing has been applied to the Search Screen, too.

What’s in it for brokers

This feature makes interaction with the mobile trading app more comfortable for end users increasing their desire to trade on the platform (and stay with their preferred broker).

Management Console

New features in DXmc, the DXtrade CFD/Crypto admin UI.

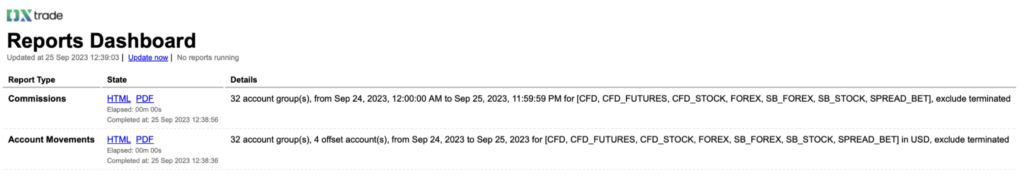

Reports Dashboard

The DXtrade reporting engine has been overhauled for asynchronous operation. Now, broker reports are placed into a queue upon request and can be accessed later via a dedicated dashboard. Real-time updates on report generation status are also available. Finished reports are stored permanently in the system, so you can download them at any time without having to generate them again.

What’s in it for brokers

The overhauled reporting engine gives brokers more control over the generation of reports and ensures traceability. The dashboard empowers users to track progress and stay informed about the status of report generation, minimizing unnecessary generation attempts.

Back-end

Additions to the desktop dealing desk application.

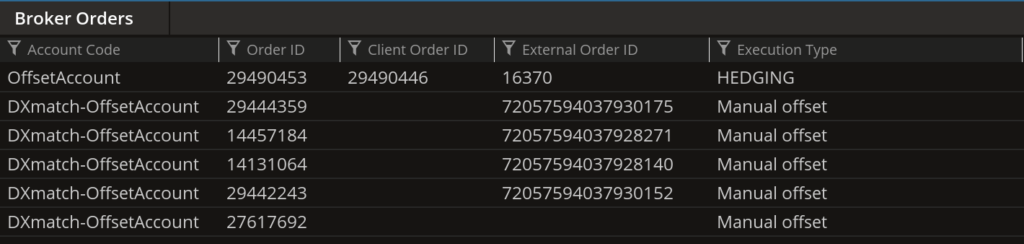

Hedging Context

Hedging context is now available in all DXdealer widgets that collect data based on client or broker orders. The following data points have been added to order execution details of hedging trades:

- External Contract Multiplier: Reflects the active External Execution domain setting

- LP’s Order Size Limit: According to the active External Execution domain setting

- Client Order Size: Initially requested client order size or stake size in the account currency for Spread Betting trades

- Conversion Rate: Rate for order size conversion (for Spread Betting trades only)

Hedging context is also provided via the REST and Push API. For orders on hedging (offset) accounts, the API now returns both the corresponding client order ID and the LP’s order ID. For rejected hedging orders, the Broker Orders widget in DXdealer now displays the actual reject reasons to facilitate investigation.

What’s in it for brokers

Client trade hedging has become much more transparent for brokers. All orders in the chain are now interconnected, which means that the entire hedging sequence can be easily tracked using order IDs or registered as historical queries in the Audit Log. This helps brokers build more effective custom hedging strategies and streamline their day-to-day operations.

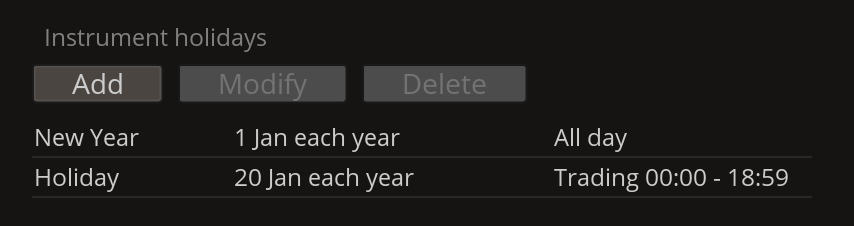

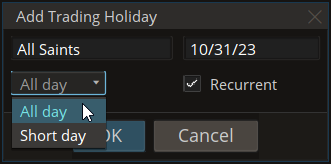

Instrument Holidays

This release introduces a new feature for planning instrument holidays. DXdealer users can now manage them in the Trading Calendar settings. Holidays can be added either as full-day events or within specific trading hours.

What’s in it for brokers

This feature is designed to simplify the work of the broker’s dealing desk personnel. Now, they don’t have to close trading for an instrument manually on a holiday and reopen it again when the holiday ends. The UI takes care of that and automates the operation.

There are also a lot of smaller improvements in this release. It is now easier to configure the platform white-labeling in the admin UI and collect metadata.

The number of available LPs has increased to a whopping twelve (shoutout to Gold-i and Broadridge NYFIX). But the platform still has room to grow, and we are dedicated to bringing it as close to perfection as possible.

Stay tuned,

The DXtrade team