Welcome back to a new DXtrade XT release (remember you can always test it here), a go-to platform for trading stocks, equities, bonds, options. In this release, we are introducing new alerts, econoday events in the Calendar, a completely revamped commission & fee engine, and multiple enhancements to the fractional OMS algorithm. Read on to learn more and don’t forget to try out our new demo color scheme!

Web Trader UI

Alerts on News and Calendar Events

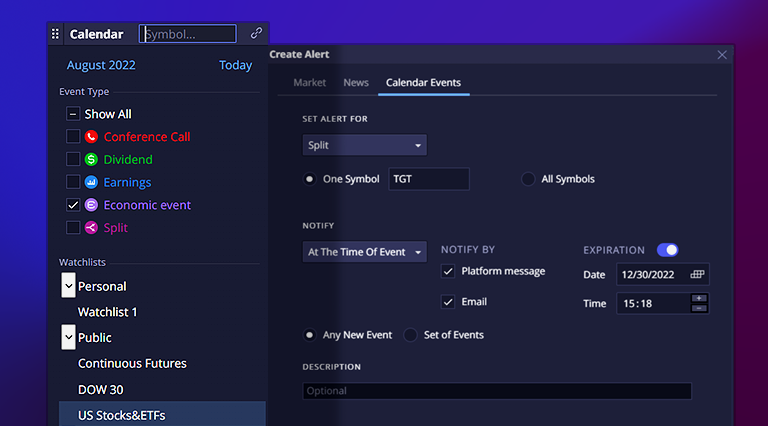

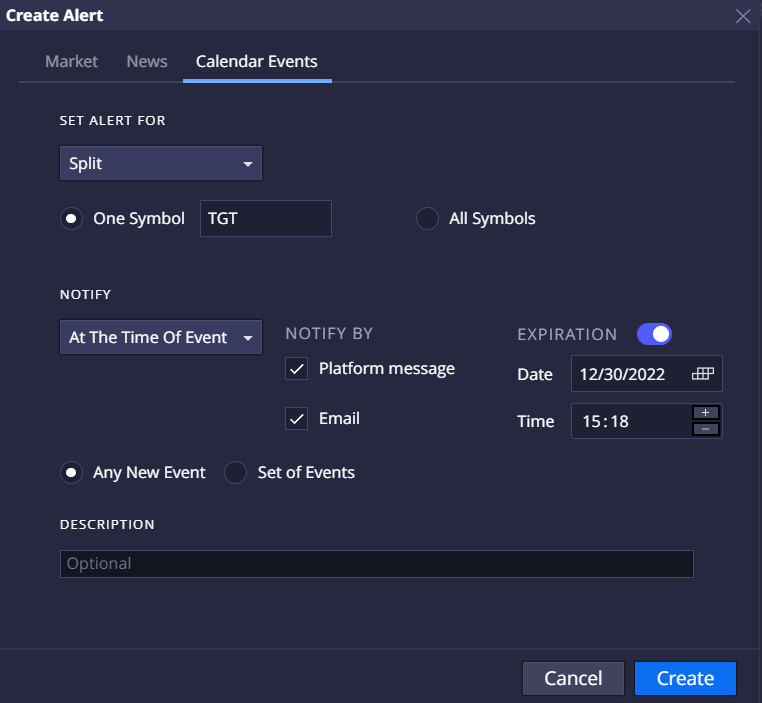

Following this release, traders can create custom alerts not only for market events but also on news and calendar events (such as Dividend, Earnings, Conference Call, etc). Alerts can be created for a specific symbol or for all supported instruments.

To create an alert on news or a calendar event, open the News or Calendar Events tabs in Alerts – Create Alert. Just as with alerts on market events, you can instruct the system to send notifications in the platform or by email and select the time when you wish to be notified.

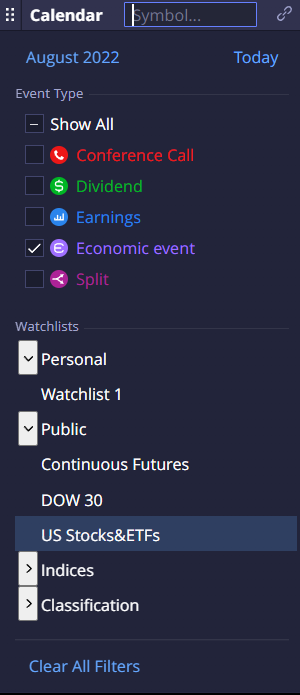

Economic Events in Calendar

The Calendar widget now supports symbol-agnostic Economic Events, or events that have an effect on the market as a whole. Now, users are able to view historical and future market events (such as Oil Reserves Number publication, Federal Reserve interest rate change, etc) in the Calendar next to company-specific events.

Web Broker UI

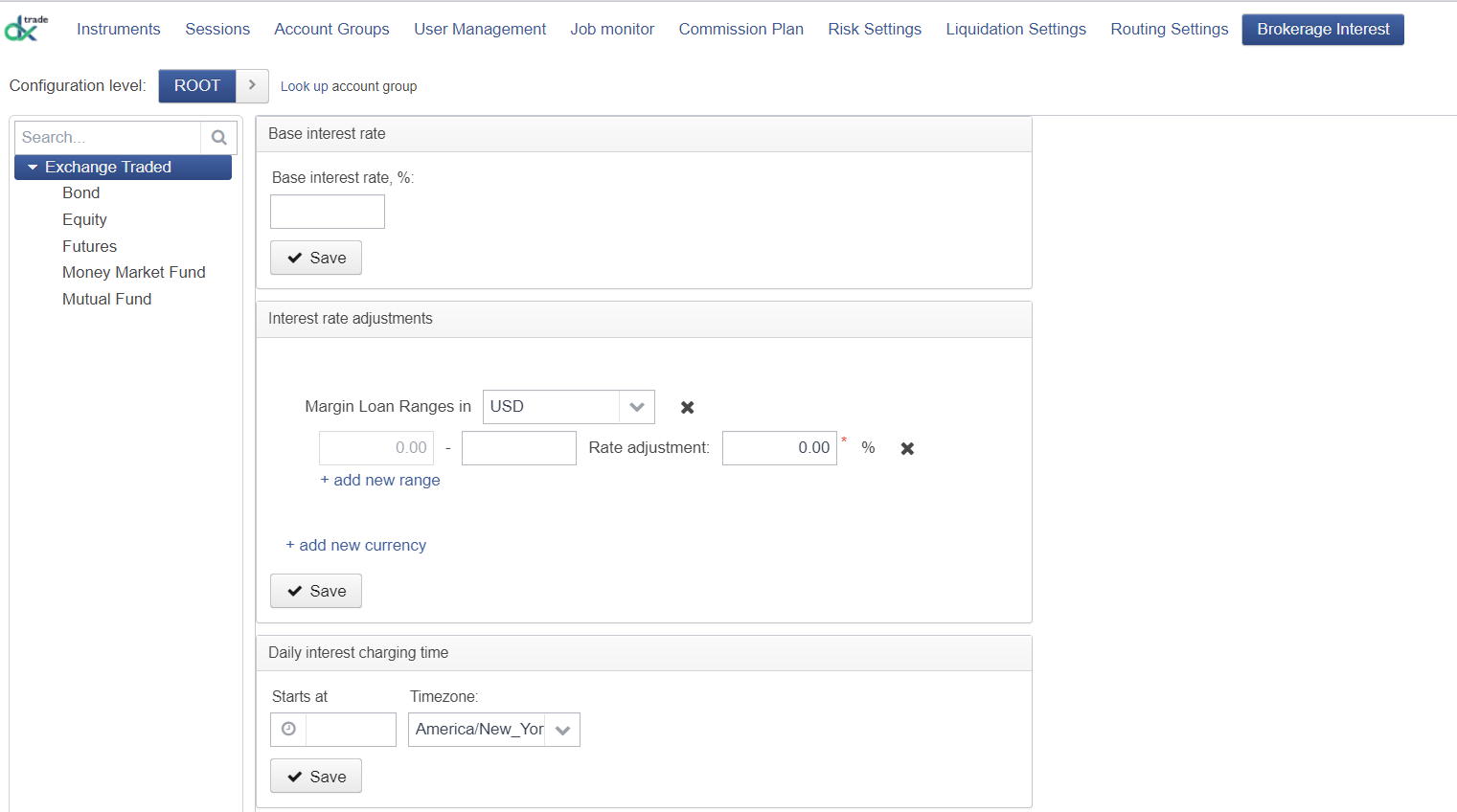

Daily Interest and Fees: Margin Loan + Short Locate

This feature allows brokers to calculate interests and fees related to margin loans + shorting securities (such as Locate Commission, Locate Fee, Short Interest Fee, and Margin Loan Interest). From this release on, brokers can configure these fees, have them calculated and charged overnight against client accounts. Fees are tracked and added to monthly reports.

This feature appears in this release as a new Brokerage Interest widget in DXmc.

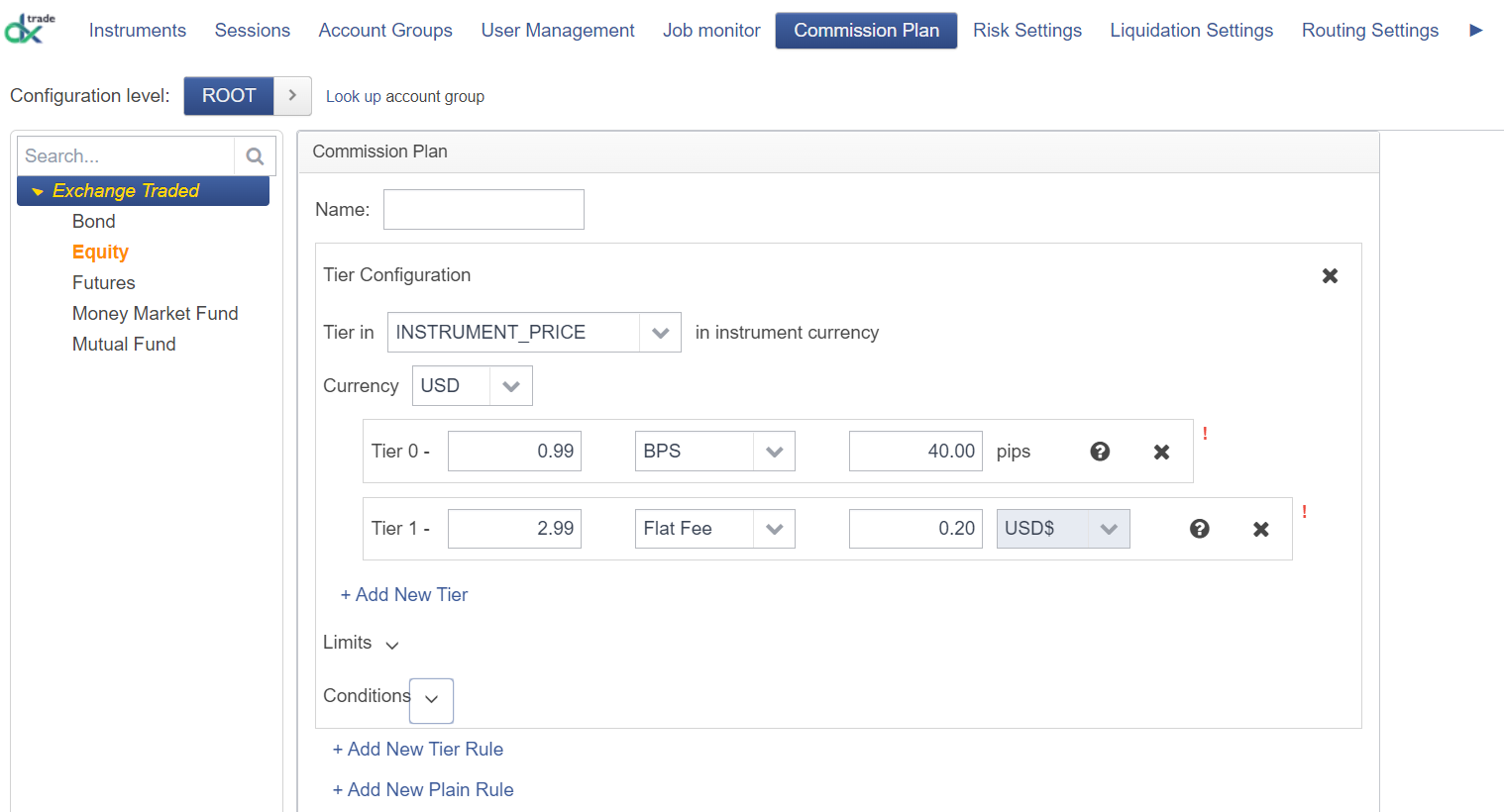

Commission Schedule + Routing Fee

This time, DXtrade XT comes with a new commission and fee engine under the hood. Now, brokers are free to configure commissions and routing fees in tiers based on instrument price. But that’s not all what this new commission engine does. Brokers can also apply conditions to their commission/fee rules depending on the position effect and order size, and configure limits on value.

To create and modify commission/fee plans, look for the new Commission Plan widget in DXmc.

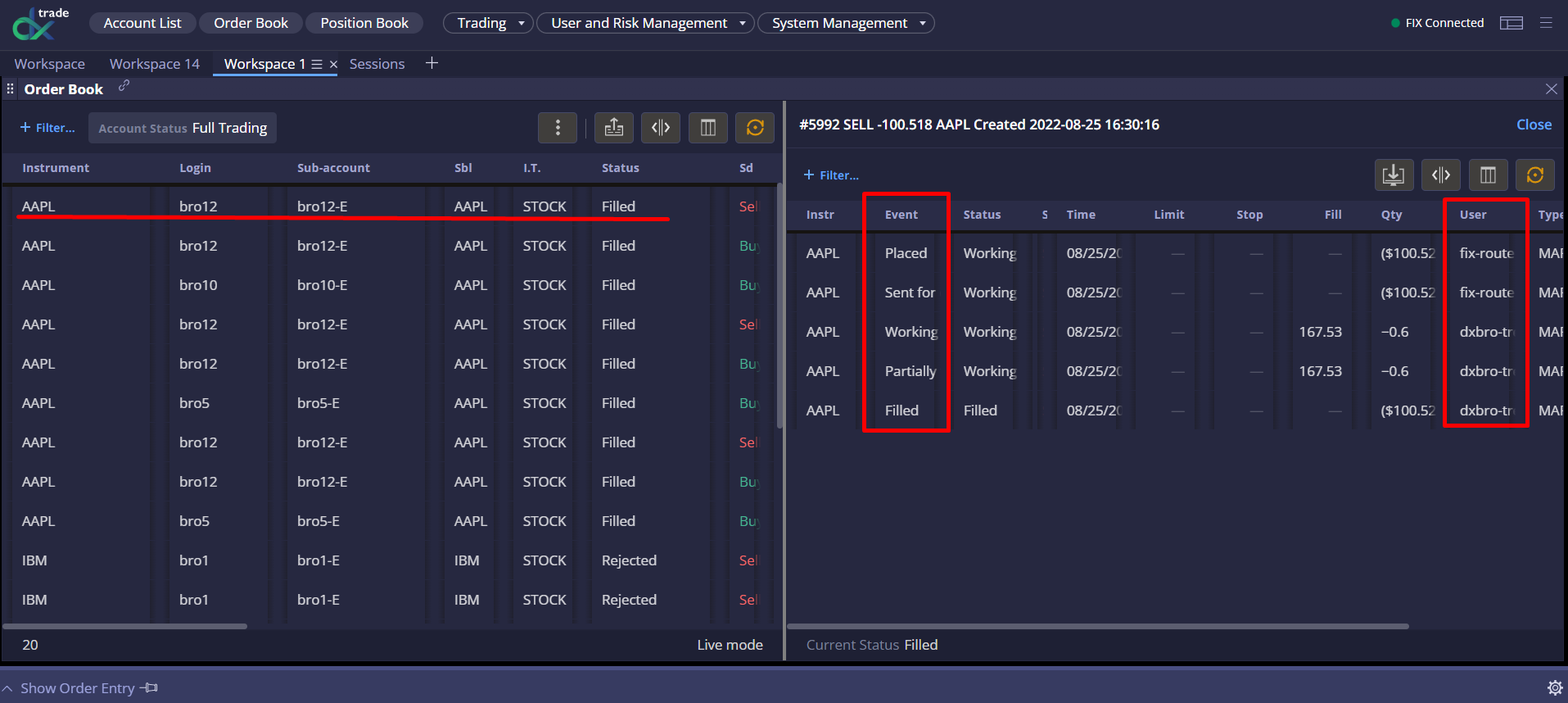

Additional Data Points in Order Book

For those brokers who require more information when auditing order history, two new columns (Event and User) were added to the Show Details section of the Order Book widget in Web Broker. This addition allows brokers to view who and what triggered a status change.

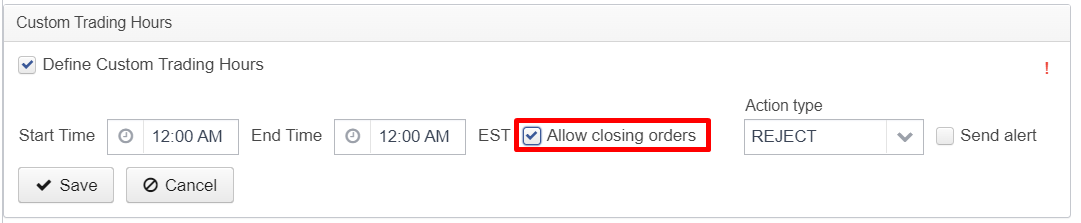

Custom Trading Hours Flexibility

In this release, a new Allow closing orders checkbox was added to allow brokers more control over how they handle closing orders. If this checkbox is activated in the Risk Settings widget, the platform will accept orders that close a position sent outside the custom trading hours. Otherwise, all such orders will be rejected.

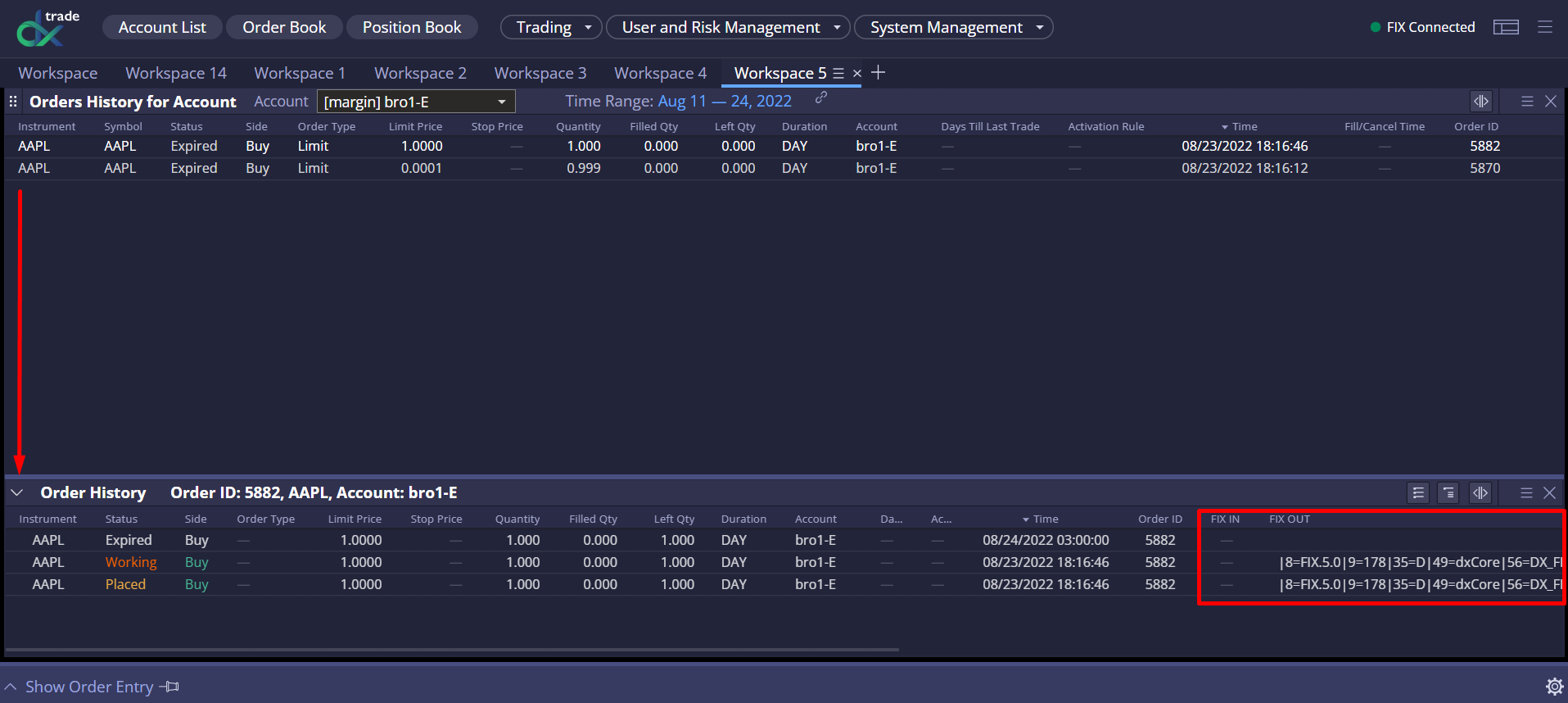

FIX Logs Storage

After this release, brokers can view stored FIX logs in the Order History section of the Order History for Account widget. Incoming FIX messages are displayed in the FIX IN column, while sent FIX messages are shown in the FIX OUT column.

New Reconciliation Parameters: Account List Additions

Four new data points were added to the Account List widget in Web Broker. These new data points are represented as selectable columns in the widget:

- Internal Account ID

- Clearing ID

- Rep Code

- Office

These new parameters were added to facilitate the SOD reconciliation process.

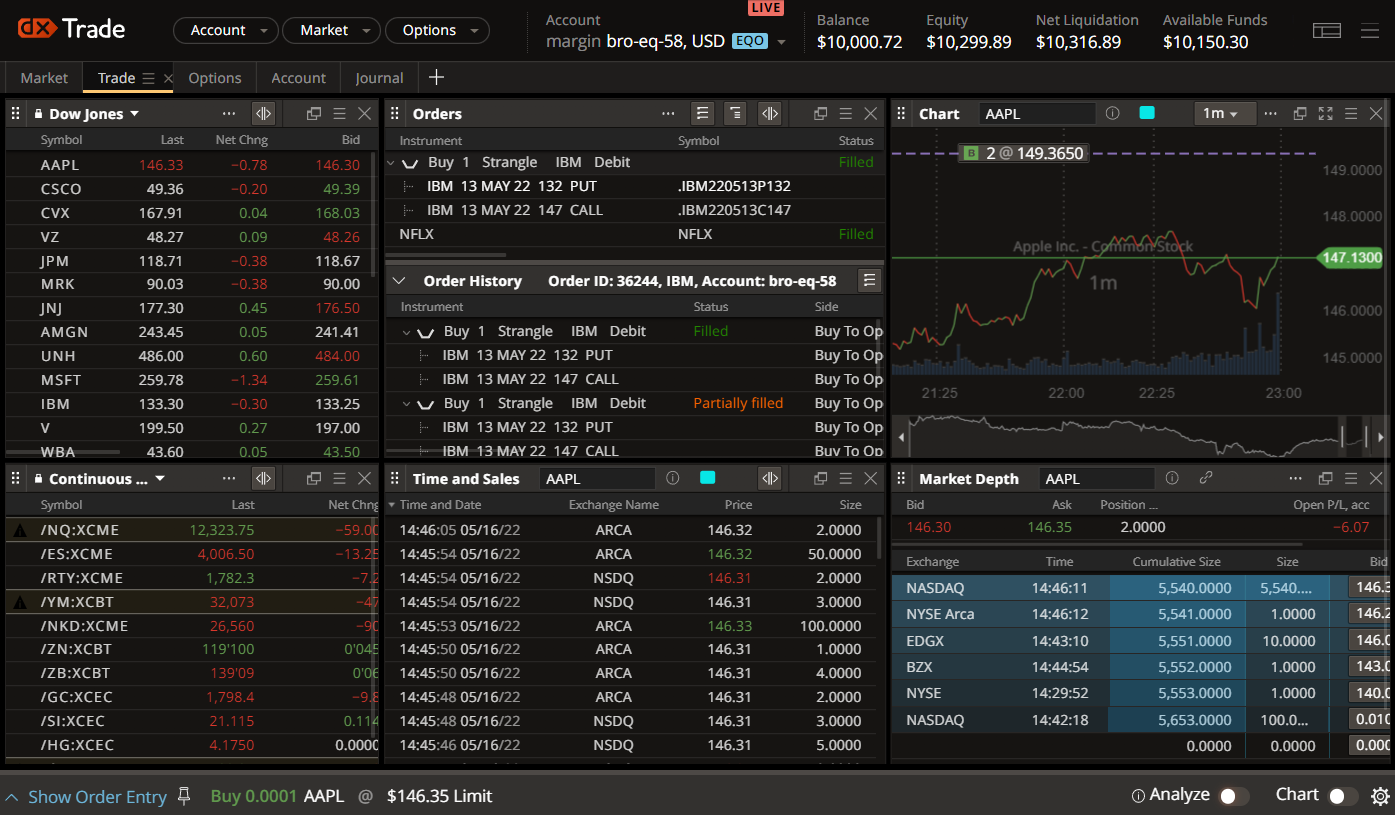

Updated Demo Color Palette

This release sees the DXtrade XT demo color scheme changed from legacy to the new product color palette. This way, the DXtrade XT demo platform comes in line with other products under the DXtrade brand and gets a more modern look and feel. However, as before, brokers can receive DXtrade XT with their custom color scheme and logo.

OMS

Fractional Share OMS Enhancements

Lot Size per Instrument

Fractional rounding algorithm as introduced in the previous release worked under an assumption that a round lot size was always 1, so a fractional/notional amount in this case had to be an increment to decimal places. For some markets, lot sizes are expressed in other increments (e.g. 10, 25, 100, 200), therefore, a fractional amount in this case could be fractional or expressed as whole numbers (e.g. 1, 5, 10, etc).

This enhancement allows brokers to set the instrument lot size in such a way that they could manage the quantity increment to support the fractional rounding algorithm.

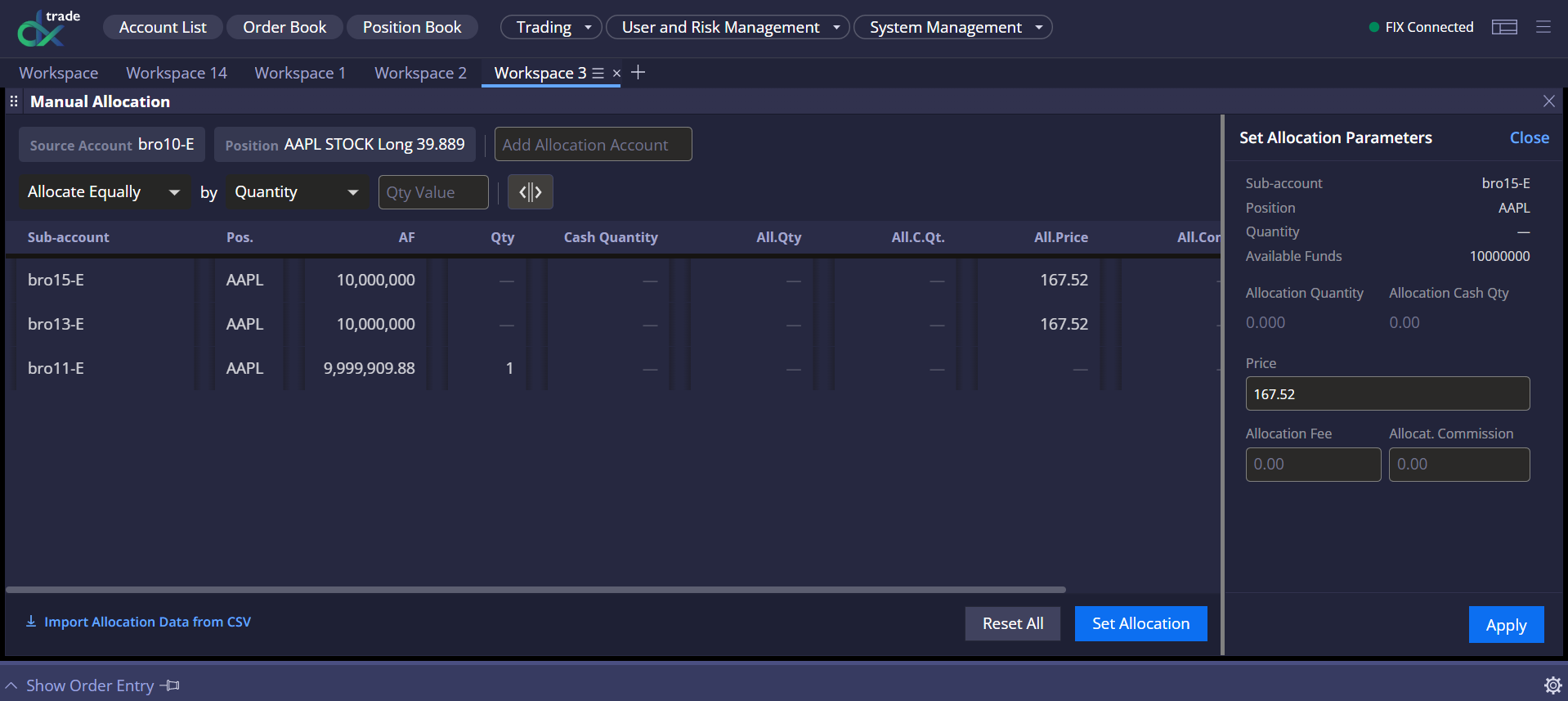

Manual Allocation UI

With this release, brokers receive a dedicated widget for manual allocation in Web Broker. Using the Manual Allocation widget, brokers can move shares from a selected source account to one or more sub-accounts. Shares can be allocated by quantity or by notional value, equally or manually. For each allocation, detailed parameters such as price, allocation fee, or allocation commission can be specified.

Automated Inventory Closure

With Fractional Inventory Management, brokers have increased exposure to market conditions within their principal accounts. After this release, brokers can configure an optional setting in the OMS to manage their inventory maximum position size automatically. If this limit is exceeded, the position will be liquidated in a whole lot quantity, and the remaining fractional quantities will stay in the inventory account. This limits the manual effort required to monitor and close full share portions of inventory positions.

Additional Sell Logic

A new Sell logic has been added to the Fractional Rounding Algorithm to support rounding to whole share lots before routing to the street. This enhancement is aimed at the brokers whose compliance requirements do not support selling fractional quantities to inventory accounts.

According to this new logic, the client order is allocated as Sell upon execution, and its fractional remainder is put against the principal inventory account.

In addition to the features listed in this longread of release notes, we’ve also made some enhancements to our API kit and prepared new integrations. Come back next time for even more exciting updates and

Stay tuned,

The DXtrade XT team