The text below explains the advantages of DXtrade for forex dealers and broker’s personnel. If you would like to experience the platform’s benefits as a trader, reach out to one of the brokers offering DXtrade.

Let’s say you’re a dealer, and you need to modify some dealing settings for a certain trader. For example, you need to change their margin and commission settings. And you’re operating a dealing console of a certain most wide-spread forex trading platform.

What’s your plan?

First, you’ll need to create a separate group for this certain trader and set the required margin and commission settings. Second, you’ll transfer your trader to this group.

Then, to make these changes come into effect, you’ll need to restart your trading server.

Usually, it takes a bit over 30 seconds. You’ve done this hundreds of times because as a dealer you have to change dealing settings a lot (generating hundreds of groups to make sure you comply with your broker’s risk management rules).

But something goes wrong this time. The server takes way longer to restart and after a good 20 minutes, your customer support is already buried under traders’ complaints about their losses and missed profit because all trading operations were brought to a halt.

How it would play out with DXtrade CFD?

When developing DXtrade CFD, we’ve thought everything through, so you as a dealer don’t need to worry about restarting servers because our mechanism of setting up risk management groups is totally different.

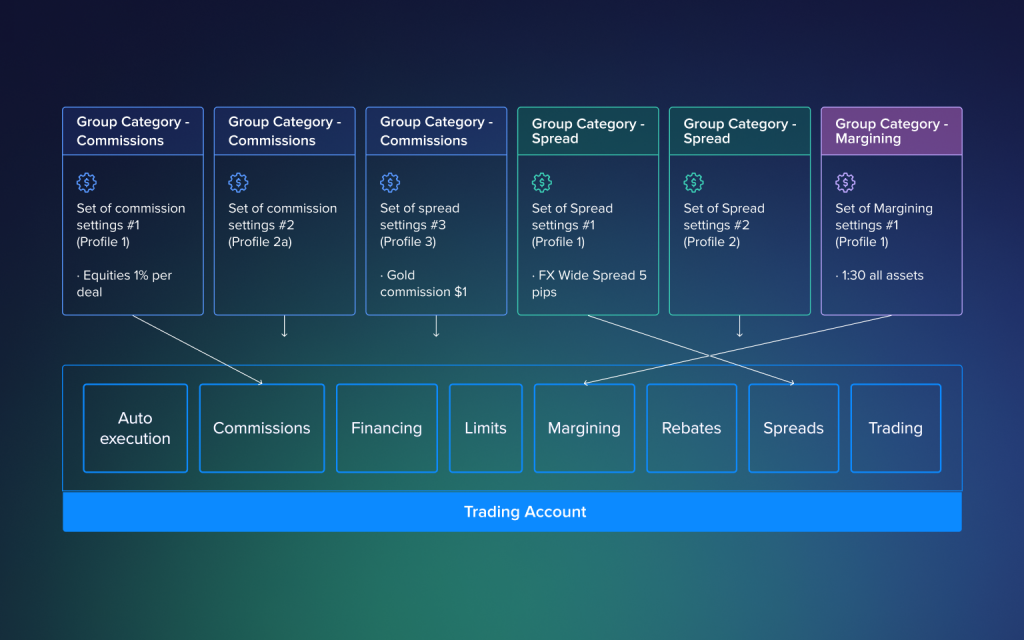

In DXtrade CFD, each trading account has several parameters that are assigned settings (we call them profiles). Examples of such parameters are commissions, limits, margins, spreads, rebates, etc.

So if you need to change a certain parameter for a trader or a group of traders, you just create a profile with respective settings and assign it to these traders. This process doesn’t require a server restart, so the trading process is uninterrupted, and changes come into effect immediately.

This way, DXtrade CFD allows modifying dealing settings in real time, ensuring that brokers and their dealing staff respond quickly to market dynamics, news events, and changes in trading conditions.

Uploading trading instruments gets more efficient

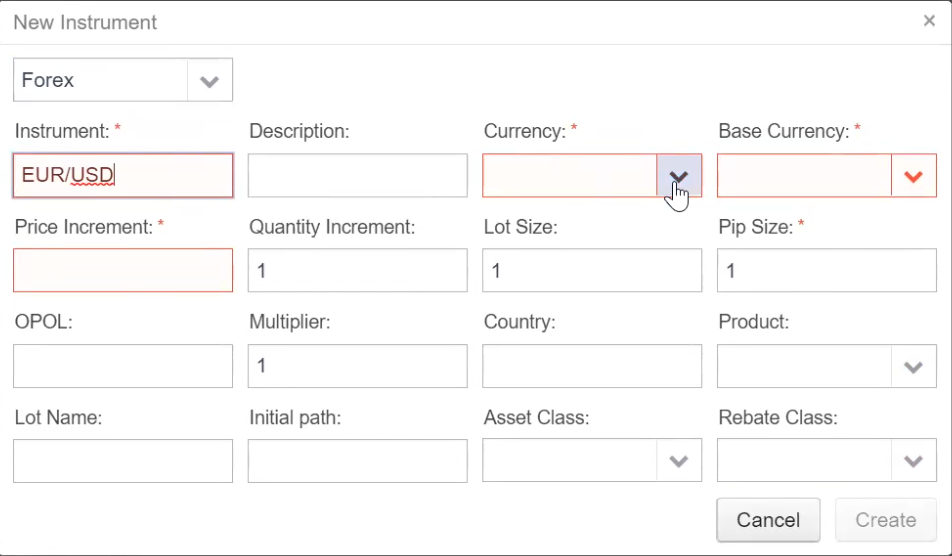

When adding a trading instrument to a trading platform, a dealer uses this platform’s backend admin panel. In the case of the most demanded platforms in the industry, dealers have two options: to add each instrument manually or upload them in bulk in a specific format, for example, a JSON file with a specific template.

Manual input takes too much time. JSON files with specific templates might be tricky for liquidity providers (and LPs might not have them at all).

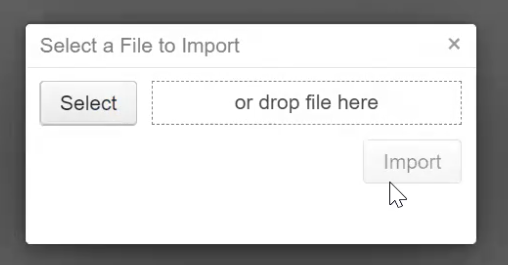

In DXtrade, besides manual input, dealers can upload trading instruments in bulk using Excel files. It’s incredibly easy for liquidity providers to generate an Excel file with lists of trading instruments (if they don’t have it yet, which is highly improbable). And even if LP’s table template needs to be modified, it takes mere minutes for dealers to do so.

This way, instrument upload becomes way more efficient, saving the time that dealers spend on this process.