Packing your picnic basket during the dog days of summer, it’s important to always remember about the future. Or futures and futures options. Now, DXtrade traders and trading contest participants are able to hit their preferred picnic destinations and trade on the go, including popular CME futures options. We’ve also overhauled our one-click trading mode for even better compatibility with props and added lots of other improvements. Read on to learn more!

Prop trading

EOD Max Drawdown validation to support Daily Drawdown

On certain accounts, such as Expert or Advanced, prop trading firms enable a Daily Drawdown feature. This release introduces the Max Drawdown value validation at the end of the trading day (EOD), based on the EOD balance to support Daily Drawdown, with EOD Max Drawdown value remaining the same throughout the trading day.

Example:

- The account starts with an initial balance of 50,000, and the Daily Trailing delta is set to 2,500. Therefore, the initial Max Drawdown will be:

50,000 – 2,500 = 47,500. - At the end of the day, the account balance is 53,000. Therefore, the Max Drawdown for the next day will be:

53,000 – 2,500 = 50,500.

The new Max Drawdown value (50,500) will be applied to the next trading session.

If at any point during the next trading day Equity or Net Liquidation falls below 50,500, the account will be liquidated with the “Close Only” status (meaning that the account has lost the contest).

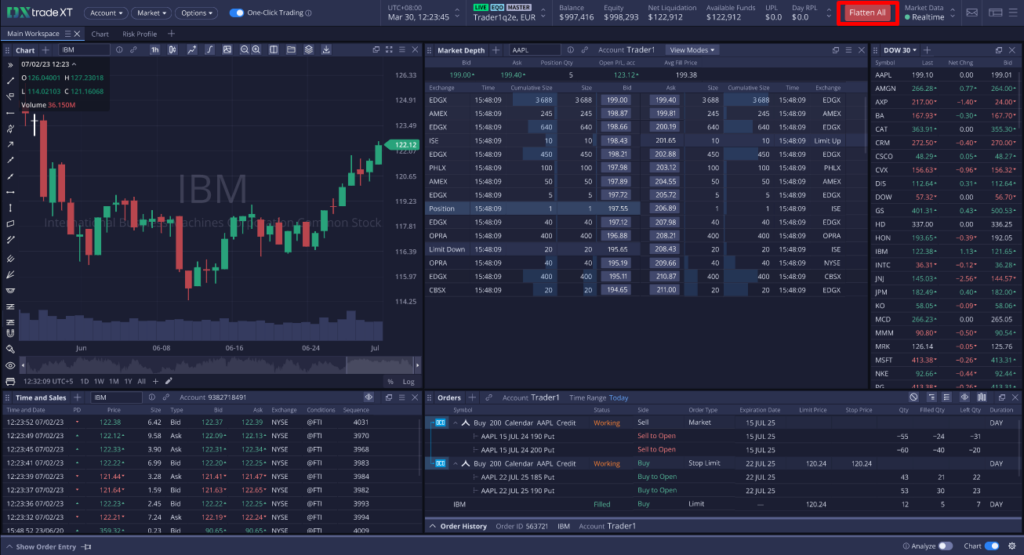

Flatten All button on Account level

In this release, the Flatten All button has been added on the Account level for web and mobile. This button closes all positions and cancels all orders for the account as follows:

- If All Accounts is selected, Flatten All applies to all accounts in the selected trading mode.

The Flatten All button can be enabled and disabled during platform configuration.

Setting to enable/disable Buying Power validation

Together with Separate Schedules, this improvement is driven by the need to support equity + equity options and futures accounts within the same prop trading platform. This release introduces a setting that is adjusted during configuration and allows enabling/disabling all Buying Power validations separately for equities + options and futures accounts. With the help of these settings, brokers may choose to disable Buying Power validations for futures accounts and keep these validations for equities + options accounts.

Separate schedules for equity and futures accounts

A platform supporting both equity + equity options and futures accounts should have separate trading schedules for futures and equities. In this release, we’ve added an extension that allows specifying different schedules for futures and equities to the trading schedule configuration setting for prop platforms.

Maximum contract size per instrument

Starting from this release, brokers are also able to control the maximum contract size per trading instrument. For this purpose, a new Exposure Limit (per Symbol) has been added to Risk Settings and as pre-trade validations, as follows:

- Exposure Limit can be adjusted in bulk for multiple instruments via the CSV file with the Max Quantity limit specified per Symbol (PRODUCT, STOCK/ETF)

- If there’s a specified value for PRODUCT, the system validates it throughout all related Futures

- If there’s a specified value for STOCK/ETF, all validations are performed only for STOCKS/ETFs.

One-click trading

DXtrade now fully supports one-click trading across the platform. One-click trading mode is enabled system-wide using a switcher in the header. Users can manipulate this switcher to switch between one-click trading and the regular trading mode. Brokers who operate platforms where one-click trading is not commonly used are free to disable the switcher at the platform configuration stage.

One-click trading is turned off by default. When a user enables one-click trading, the system shows a pop-up message that requires the user to explicitly confirm that one-click trading is to be enabled. Users are then able to designate a default account (Live/Demo) for one-click trading in the hamburger menu, for the situation where All Accounts mode is enabled.

One-click trading allows users to place, replace, cancel orders, or close positions without confirmation messages. However, confirmation messages may appear for orders with instruments with delayed quotes.

Futures options

Futures options and SPAN metrics support

SPAN metrics and futures options metrics are now fully supported in this release.

When SPAN is enabled:

- All margin metrics are calculated at the Combined Commodity level (in CME terms).

- If a trader aggregates positions by underlying, futures accounts will be automatically aggregated by combined commodity in line with the margin calculation level.

- Total margin metrics (intraday/overnight) are derived from the SPAN algorithm.

- All other metrics, such as net liquidation and equity to margin, are based on the updated metric set.

Individual per-position margining remains available for platforms with futures trading only (no options). Brokers operating these platforms can choose to enable full SPAN margin or not.

However, for futures options trading, only full SPAN margin can be applied.

Support for CME futures options trading, including multilegs

Starting from this release, the platform supports trading in CME futures options. Futures options paper money trading is also available. The system can now also issue and execute multileg orders for futures options.

Portfolio simulation

The platform can now generate prospective portfolios for futures and futures options. That means that the platform supports pre-trade margin validation for accounts with SPAN margining enabled. The SPAN algorithm includes predefined margining spreads with assigned priorities and returns the initial margin and maintenance margin for each combined commodity and total portfolio.

Mobile

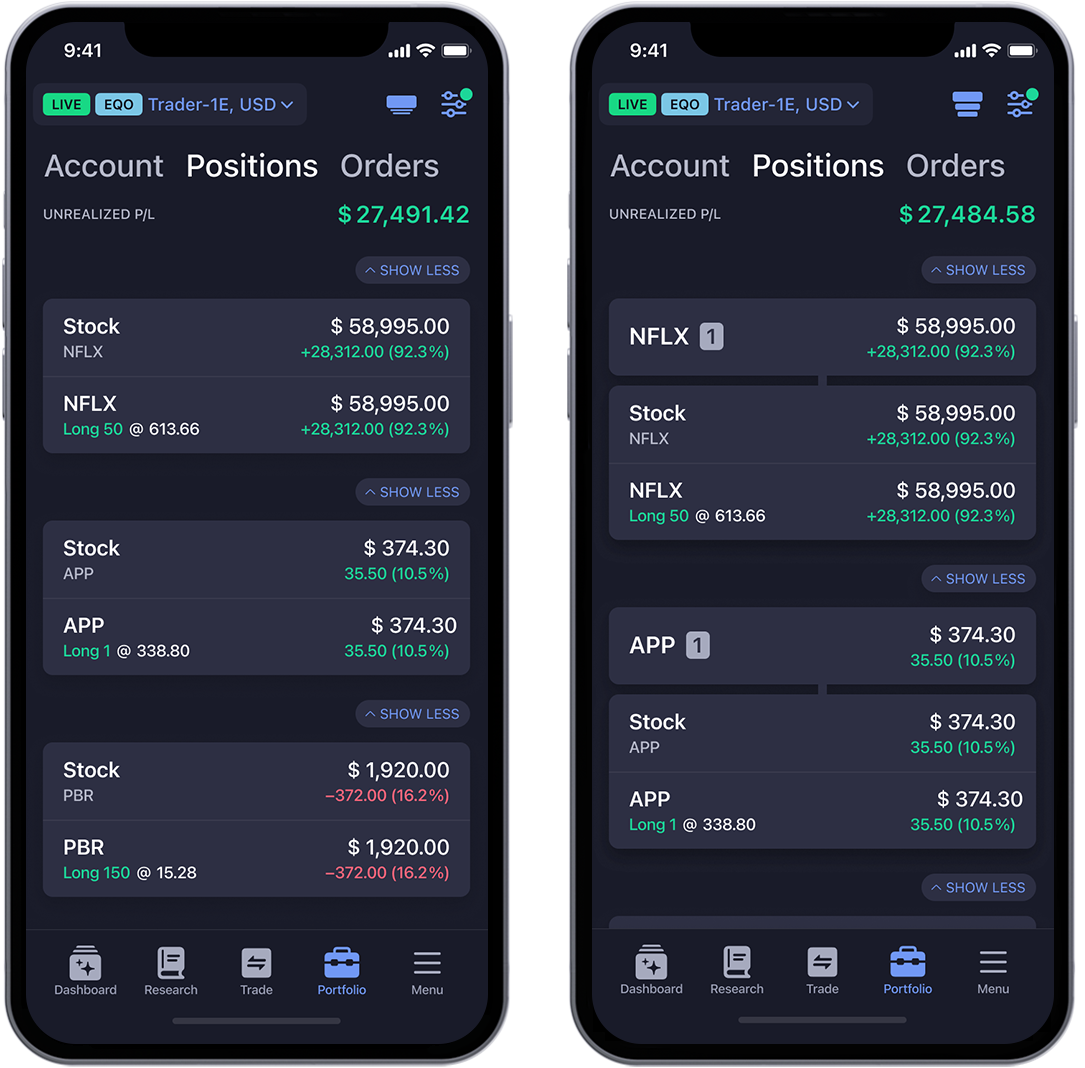

Position aggregation by spread/orders

Position aggregation management has been introduced in this release. For this purpose, the Aggregate by Underlying icon in Positions has been replaced with Aggregation Settings, where aggregation parameters can be selected (including aggregation by order).

For All Accounts mode, the default aggregation is by account, and aggregation by underlying under aggregation by account is the default for derivatives.

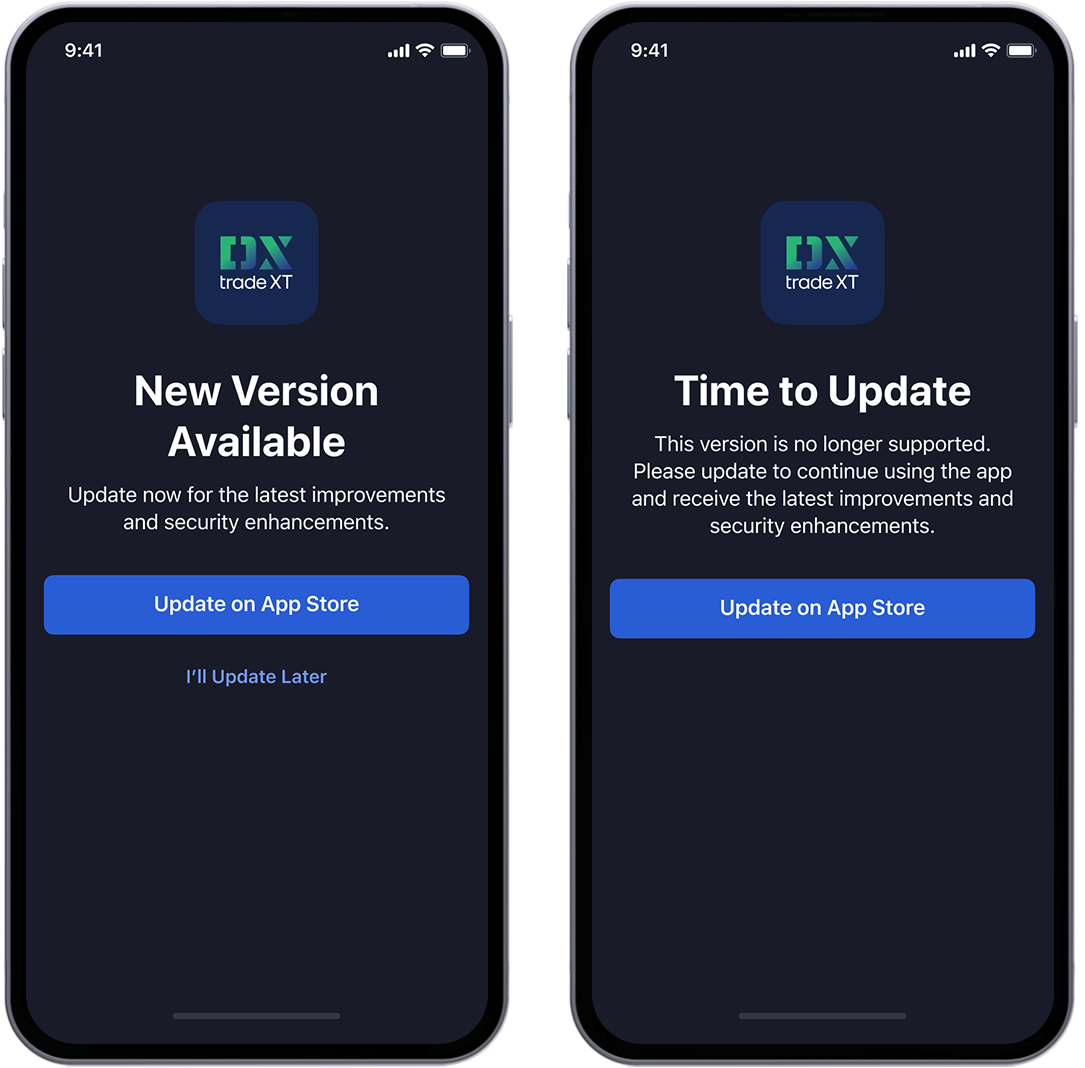

Recommended and forced app update

To ensure full compatibility of users’ apps with the current version, the strategy of recommended and forced updates has been introduced in this release. Now, users will be first reminded to update their app as soon as the newest version is available. The users are free to either update their app or opt out and do it later. When the existing user’s version of the app is no longer supported, they will be notified and redirected to the forced update screen.

We hope you’ve enjoyed this beach read with the DXtrade updates and that you like the updates themselves even more. DXtrade keeps growing and improving every day—keep an eye out for more asset classes supported and more UX/UI tweaks introduced. In the meantime,

Stay tuned,

The DXtrade team