London, February 18, 2025 – Devexperts has today announced the launch of DXtrade Institutional, a fully customizable single-dealer multi-asset platform offering, designed for banks, hedge funds, asset managers, and market makers looking to upgrade their frontend legacy systems.

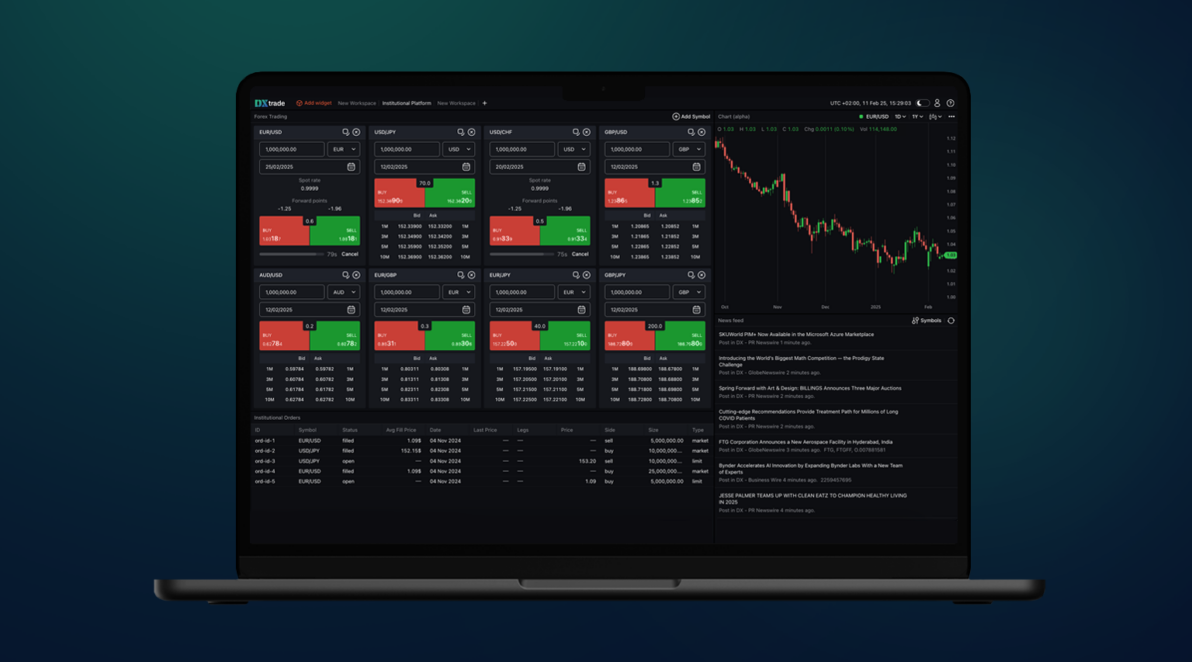

Unlike the white-label, off-the-shelf, DXtrade variants, DXtrade Institutional will be tailor-built intuitively using customers’ existing platforms as a basis. DXtrade Institutional will offer a scalable, multi-asset solution with seamless back-end integration and a modern user interface, and enable institutions to execute trades directly while maintaining full control over pricing, risk management, and liquidity distribution.

This is the first DXtrade product we have launched that is not an off-the-shelf solution, but built specifically for each customer, offering a tailored solution that builds on and improves their existing software and meets firms’ unique operational needs.

Supporting spot, forwards, swaps, and options trading, DXtrade Institutional will provide direct trade execution; advanced risk management, including pre- and post-trade risk controls; full customizability; and UX-focused design for improved trader efficiency. The offering will also provide full scalability and flexible deployment options, enabling it to adapt and grow according to evolving institutional needs.

The standout aspect of DXtrade Institutional is that it comes with a dedicated team offering deep institutional trading software development expertise. Devexperts focuses on building long term relationships with its customers, meaning firms will have ongoing access to this expertise, as well as support to ensure software is maintained and optimized, both in the short and long term.

We developed DXtrade Institutional with a view to helping banks, hedge funds, asset managers, and market makers to ensure their technology is up-to-date and competitive, without the need to invest in internal development resources, which can be both time-consuming and costly.

With 20+ years’ experience in software development and consulting for the global capital markets, Devexperts offers a proven track record in the delivery of institutional FX trading solutions, with extensive expertise in institutional-grade trading infrastructure and API-driven architectures. Devexperts focuses on helping capital markets firms grow, adapt, and maintain a competitive edge, and has created some of the most trusted and widely used trading technology applications in the industry.

We are really pleased to be bringing our consultancy and custom development expertise to single-dealer firms, and believe DXtrade Institutional can offer a solution to those working with legacy systems that delivers strong, long-lasting, outcomes for optimized user experience and robust return on investment.time-consuming and costly.

For more information, please get in touch here.