Meet cash accounts aka direct exchange, new Funds widget in Web Trader, revamped Market Depth, and a load of mobile and Client Portal improvements—our largest update so far!

Web

Rolling Out Cash Accounts

Great news for crypto traders: we are rolling out cash account support, effective from this release on. Cash accounts are also known as direct exchange accounts and serve to exchange assets without leverage and having to open positions. It means that currency is exchanged immediately between the market participants. Crypto enthusiasts may find cash accounts a more comfortable way to trade.

In this release, users will be able to open cash accounts, make trades, convert funds, and view specific metrics. To find out if you are trading from a cash account or otherwise, look no further than the header: these accounts are labeled SPOT.

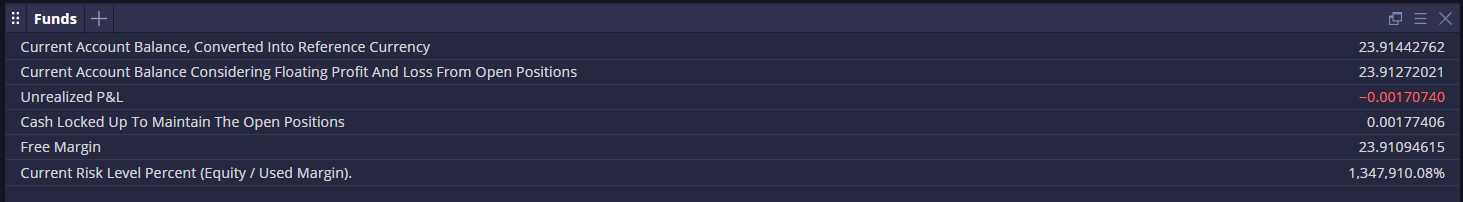

Funds Widget

Cash account holders now have a widget tailored to their needs. Funds is a widget that breaks down the balances of a cash account. It also works with margin accounts.

Updated Market Depth Widget

In this release, the Market Depth widget gets a revamped look and feel as well as new functionality. Now users can trade directly from this widget and view their working orders. Cumulative volume display is also supported.

Mobile

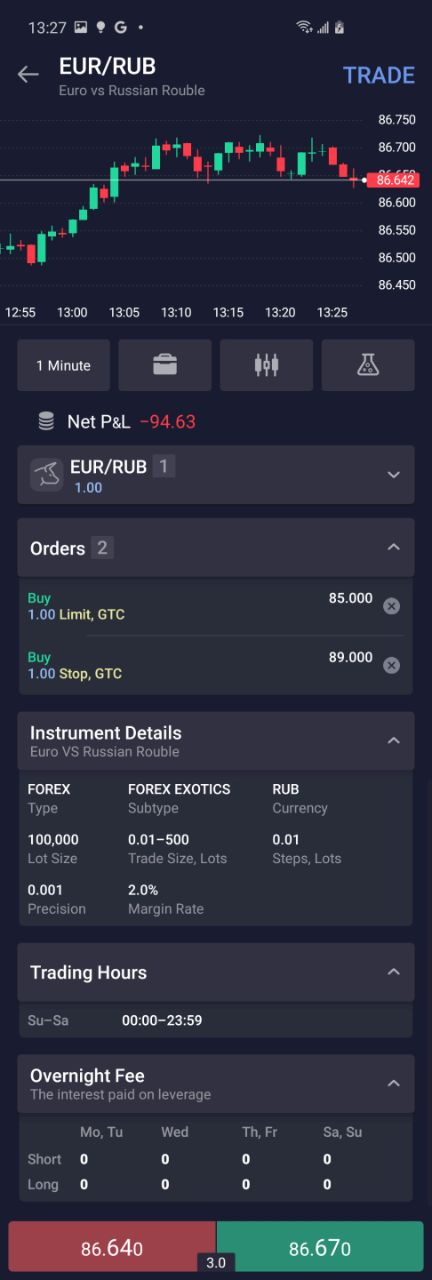

Full Instrument Details in Android

Android mobile clients now display full instrument details, trading hours schedule, and overnight financing fees.

Server-Side Watchlists in Android

This release gives Android users server-side watchlist support. Now traders can create, delete, reorder, and modify the watchlists stored on the server and shared between instances of mobile applications and Web Trader.

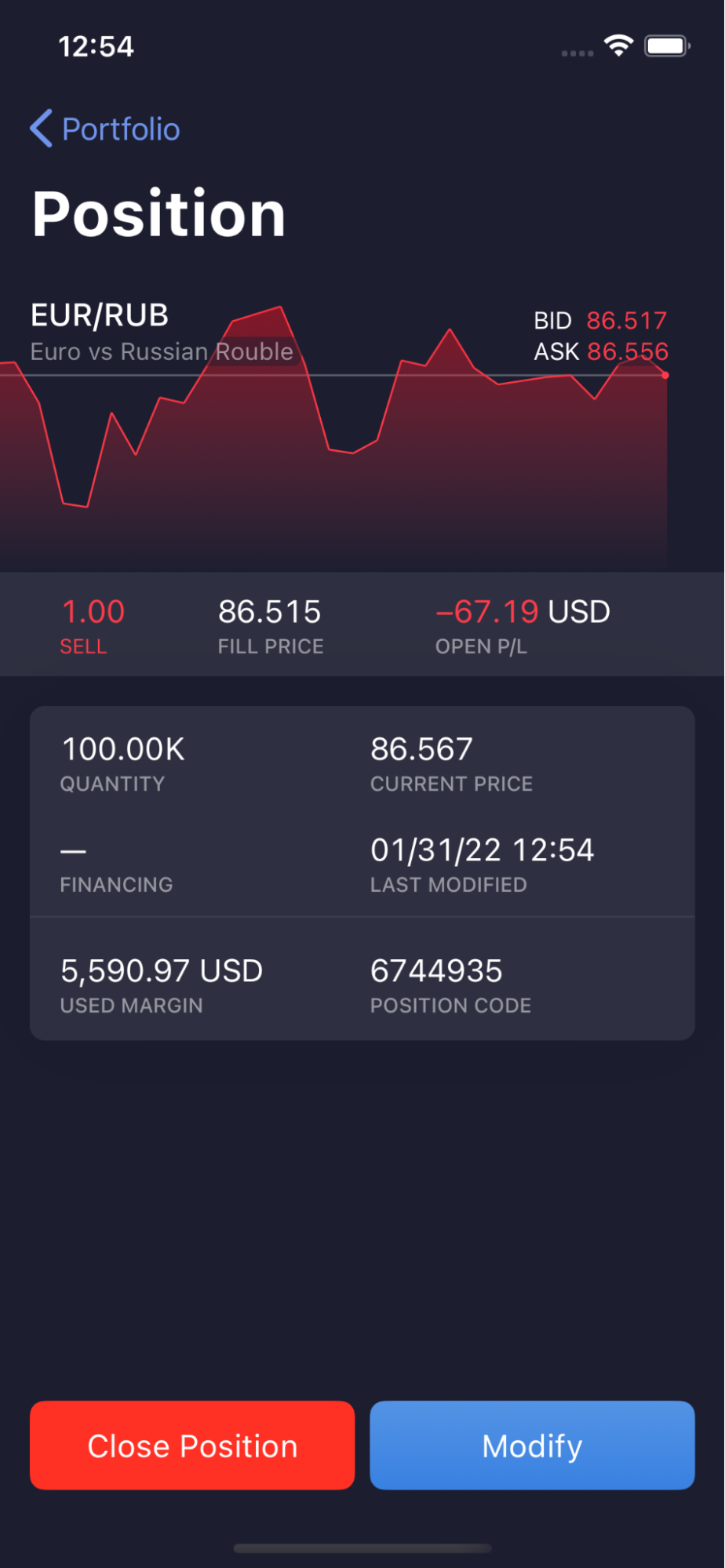

Financing for Open Positions

In this release, total financing (rollover) charged for an open position is displayed in both iOS and Android versions.

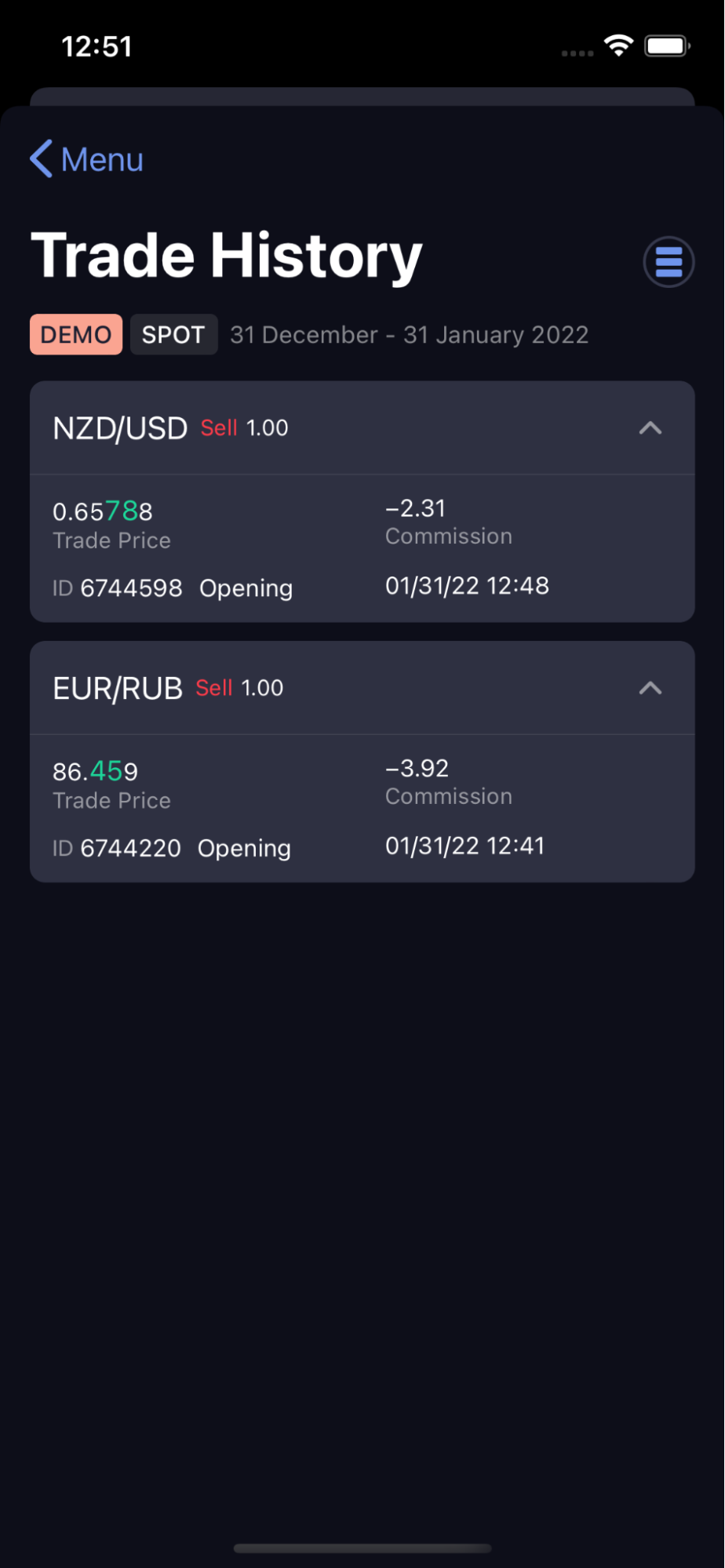

Trade History in iOS

iOS users are now able to view trade history, a feature previously supported only in Android clients.

Client Portal

Customizable KYC

In another improvement of the Client Portal, it now comes with a fully customizable KYC procedure. Brokers can configure their own set of questions for the questionnaire, set out validation rules, collect KYC data and approve it. This improvement gives brokers the opportunity to tailor the KYC procedure to their needs.

Configurable Deposit Instructions

As of this release, brokers can configure money deposit instructions for their clients. Brokers are free to upload and display several sets of instructions depending on the deposit currency (fiat or crypto). Crypto deposits are powered by Bitgo out of the box.

Configurable Withdrawal Instructions

Just as with deposits, brokers can configure and display withdrawal instructions to their clients. The Client Portal now supports different sets of instructions for fiat and crypto withdrawals. Brokers can also create a custom withdrawal form and specify the type of data that should be collected. The withdrawal procedure has received a built-in confirmation mechanism: the Portal admin can review the withdrawal request, approve, or reject it.

Back-Office

Statistics Data for Brokers

Starting with the new release, we configure every broker platform to report business-level statistics at specific intervals. The reports are delivered over email and contain important business metrics such as trading volume, user logins, funded accounts, and number of positions.

And it is just a very big tip of a massive iceberg: we’ve also squashed more than 150 bugs and introduced UI and accessibility improvements. Rumor has it that even more is to come in April, so stay alert and tuned,

The DXtrade team